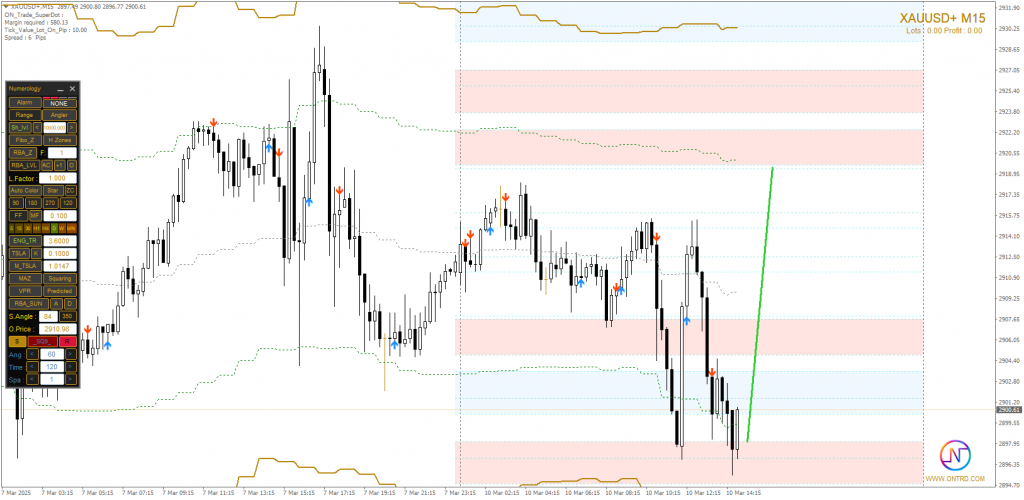

XAU/USD Chart Overview

Gold analyze prices have shown significant volatility in today’s session, with sharp movements reflecting the ongoing market sentiment. The XAU/USD pair is currently trading around $2900.61, having tested key support and resistance levels.

Key Support and Resistance Levels by Gold analyze

| Level | Price (USD) |

|---|---|

| Resistance 1 (R1) | 2922.80 |

| Resistance 2 (R2) | 2927.95 |

| Resistance 3 (R3) | 2931.90 |

| Support 1 (S1) | 2900.61 |

| Support 2 (S2) | 2896.77 |

| Support 3 (S3) | 2890.70 |

Market Scenarios for Today by Gold analyze

🔵 Bullish Scenario (Buying Opportunity)

If gold holds above the $2896.77 support level and builds momentum:

- A break above $2905 may trigger a push toward $2915 – $2922.80.

- If buying pressure continues, a sustained move beyond $2927.95 could lead to further gains toward $2931.90 or higher.

- The ideal confirmation for a bullish trend would be a strong close above $2922.80 on the M15 or M30 chart.

🔹 Key Factors Supporting This Scenario:

- A weaker US dollar or declining bond yields.

- Geopolitical tensions increasing demand for gold as a safe-haven asset.

- Positive momentum on intraday indicators, such as RSI and MACD.

🔴 Bearish Scenario (Selling Opportunity)

If gold fails to break above $2922.80 and faces resistance:

- A rejection at $2922.80 – $2927.95 could push the price lower.

- A break below $2900.61 may lead to further downside toward $2896.77.

- If selling pressure increases, gold could test $2890.70, and a break below this level might open the door for deeper losses.

🔹 Key Factors Supporting This Scenario:

- A stronger US dollar or rising bond yields.

- Hawkish comments from the Federal Reserve, signaling higher interest rates.

- A significant bearish candlestick formation on lower timeframes (M15-M30).

Key Factors Influencing Gold Prices Today

1. Market Sentiment & Safe-Haven Demand

Gold remains a preferred safe-haven asset amid global uncertainty. Geopolitical tensions, stock market fluctuations, and risk-off sentiment could drive demand for gold. Conversely, a stable market environment may reduce its appeal.

2. US Dollar Strength & Bond Yields

- A stronger US dollar often exerts downward pressure on gold prices. Traders are closely watching the US Dollar Index (DXY) for potential movements.

- Rising US Treasury yields may weaken gold’s demand, as higher interest rates make non-yielding assets like gold less attractive.

3. Key Technical Levels & Breakout Potential

- If gold breaks above $2922.80, further bullish momentum could take the price toward $2927.95 and beyond.

- However, a drop below $2896.77 may signal more downside risk, potentially targeting $2890.70 or lower.

Major Economic News Impacting Gold Today

- US Non-Farm Payrolls (NFP) Report

- A strong NFP release could boost the dollar and push gold prices lower. A weaker-than-expected report may trigger a gold rally.

- Inflation Data (CPI & PPI Reports)

- High inflation could increase demand for gold as an inflation hedge, while lower inflation may reduce its appeal.

- Federal Reserve Policy & Interest Rate Outlook

- Statements from Fed officials regarding future rate hikes or cuts will significantly influence gold price movements.

- Geopolitical Events & Global Market Uncertainty

- Any sudden economic instability or geopolitical conflicts could increase demand for gold as a safe-haven asset.

Conclusion

Gold is currently at a critical decision point, with price action near key support and resistance levels.

📌 Traders should:

- Monitor price action around $2900.61 for signs of a bounce or breakdown.

- Watch for confirmation signals before entering trades.

- Stay updated on major economic events that could shift market sentiment.

Would you like any refinements or additional insights? 😊

For More Info Contact Us.

Check Also :