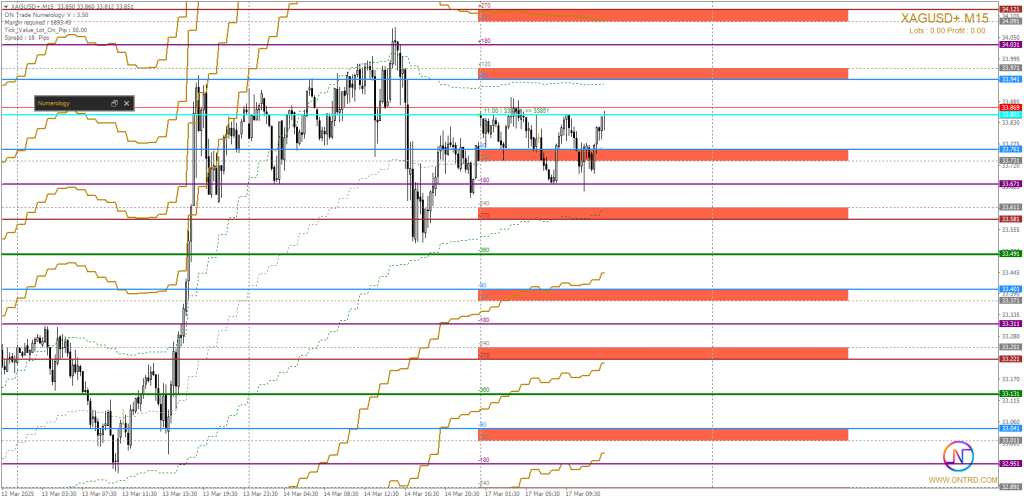

XAG/USD Chart Overview

Recent geopolitical tensions have heightened uncertainty in the global markets, leading investors to seek safe-haven assets like XAGUSD. The fluctuating stock market and prevailing risk-off sentiment further emphasize the appeal of silver in today’s economic landscape. On the other hand, a stable market environment might diminish the attractiveness of XAGUSD to some extent. Amidst these dynamics, the strength of the US dollar and bond yields play a pivotal role in shaping the direction of XAGUSD prices. Analyzing key technical levels and breakout potential becomes essential in navigating the market movements associated with XAGUSD.

Key Support and Resistance Levels by XAGUSD Analyze

Current Trends in XAGUSD Markets

As we analyze market trends, it’s essential to note how silver prices react under current conditions. Investors are continually looking for patterns that can indicate future movements in XAGUSD.

Resistance Levels:

| Level | Price (USD) |

|---|---|

| R1 | 33.94 |

| R2 | 33.97 |

| R3 | 34.04 |

| R4 | 34.12 |

Support Levels:

| Level | Price (USD) |

|---|---|

| S1 | 33.76 |

| S2 | 33.67 |

| S3 | 33.49 |

| S4 | 33.40 |

XAGUSD Market Insights

Silver has shown resilience against economic fluctuations, making it a key asset for traders. Understanding the silver market will help traders make informed decisions.

Market Scenarios for Today by XAGUSD Analyze

🔵 Bullish Scenario (Buying Opportunity)

If XAGUSD holds above the $33.76 support level and builds momentum:

- A break above $33.85 may trigger a push toward $33.94 – $33.97.

- If buying pressure continues, a sustained move beyond $34.04 could lead to further gains toward $34.12 or higher.

- The ideal confirmation for a bullish trend would be a strong close above $33.94 on the M15 or M30 chart.

🔹 Key Factors Supporting This Scenario:

- A weaker US dollar or declining bond yields.

- Geopolitical tensions increasing demand for silver as a safe-haven asset.

- Positive momentum on intraday indicators, such as RSI and MACD.

🔴 Bearish Scenario (Selling Opportunity)

If XAGUSD fails to break above $33.94 and faces resistance:

- A rejection at $33.94 – $33.97 could push the price lower.

- A break below $33.76 may lead to further downside toward $33.67.

- If selling pressure increases, XAGUSD could test $33.49, and a break below this level might open the door for deeper losses.

Why Invest in XAGUSD?

Investing in silver provides a hedge against inflation and a way to diversify portfolios. The stability of silver makes it an appealing choice for long-term investors.

🔹 Key Factors Supporting This Scenario:

- A stronger US dollar or rising bond yields.

- Hawkish comments from the Federal Reserve, signaling higher interest rates.

- A significant bearish candlestick formation on lower timeframes (M15-M30).

Key Factors Influencing XAGUSD Prices Today

1. Market Sentiment & Safe-Haven Demand

Silver remains a preferred safe-haven asset amid global uncertainty. Geopolitical tensions, stock market fluctuations, and risk-off sentiment could drive demand for XAGUSD . Conversely, a stable market environment may reduce its appeal.

2. US Dollar Strength & Bond Yields

- A stronger US dollar often exerts downward pressure on XAGUSD prices. Traders are closely watching the US Dollar Index (DXY) for potential movements.

- Rising US Treasury yields may weaken silver’s demand, as higher interest rates make non-yielding assets like XAGUSD less attractive.

3. Key Technical Levels & Breakout Potential

- If XAGUSD breaks above $33.94, further bullish momentum could take the price toward $33.97 and beyond.

- However, a drop below $33.76 may signal more downside risk, potentially targeting $33.67 or lower.

XAGUSD’s Role in Portfolio Management

Including silver in investment portfolios can enhance overall performance by providing balance during market volatility.

Market Economic Events That Effecting XAGUSD

1. US Retail Sales Data Impact

Today’s US retail sales data showed a significant decline, with core retail sales dropping by -0.5% and overall sales declining by -0.9%. This indicates weaker consumer spending, which could weigh on the US dollar and support XAGUSD prices.

2. Federal Reserve Policy & Interest Rate Outlook

- Traders will be watching for comments from Fed officials regarding future rate hikes or cuts.

- Hawkish statements could strengthen the dollar and pressure XAGUSD , while dovish remarks may boost XAGUSD prices.

3. Geopolitical Events & Safe-Haven Demand

- Any unexpected geopolitical tensions or global market instability could increase demand for XAGUSD as a safe-haven asset.

4. Technical Levels & Breakout Potential

However, a drop below $33.76 may signal more downside risk, potentially targeting $33.67 or lower.

XAGUSD Trading Tips

Silver Trading Tips

When trading silver, consider market trends, economic indicators, and geopolitical developments that may affect prices. Staying informed is crucial for successful trading.

The future of silver appears promising as industrial demand rises and geopolitical tensions persist. Traders should keep a close watch on silver’s price dynamics.

📌 Trading Tips for XAGUSD Traders Today

With the current market volatility, traders need a well-structured approach to maximize opportunities while minimizing risks. Here are some key tips for trading XAG/USD today:

1️⃣ Stay Updated with Economic News

Today, several key economic reports, including US inflation data and Federal Reserve statements, could impact XAGUSD prices. Keep an eye on the economic calendar and avoid trading during high-impact news releases.

2️⃣ Use Technical Analysis for Entry & Exit Points

- Identify key support and resistance levels before entering a trade.

- Use confirmation signals like RSI and MACD before making buy/sell decisions.

- Monitor price action on M15 and M30 timeframes for more accurate entries.

3️⃣ Implement Risk Management Strategies

- Set stop-loss levels below support (for buys) or above resistance (for sells).

- Avoid over-leveraging, as XAGUSD can be highly volatile.

- Use a risk-reward ratio of at least 1:2 to maximize profitability.

4️⃣ Monitor Market Sentiment & USD Movements

- A weakening USD can push XAGUSD prices higher, while a stronger dollar may lead to declines.

- Follow the US Dollar Index (DXY) and bond yield trends to anticipate price moves.

5️⃣ Plan Your Trading Day Wisely

- Start the day by analyzing key levels and setting alerts.

- Avoid emotional trading; stick to your predefined strategy.

- Review trades at the end of the day to learn from market behavior.

Conclusion

XAGUSD is currently at a critical decision point, with price action near key support and resistance levels.

📌 Traders should:

- Monitor price action around $33.85 for signs of a bounce or breakdown.

- Watch for confirmation signals before entering trades.

- Stay updated on major economic events that could shift market sentiment.

For More Info Contact Us.

Check Also: