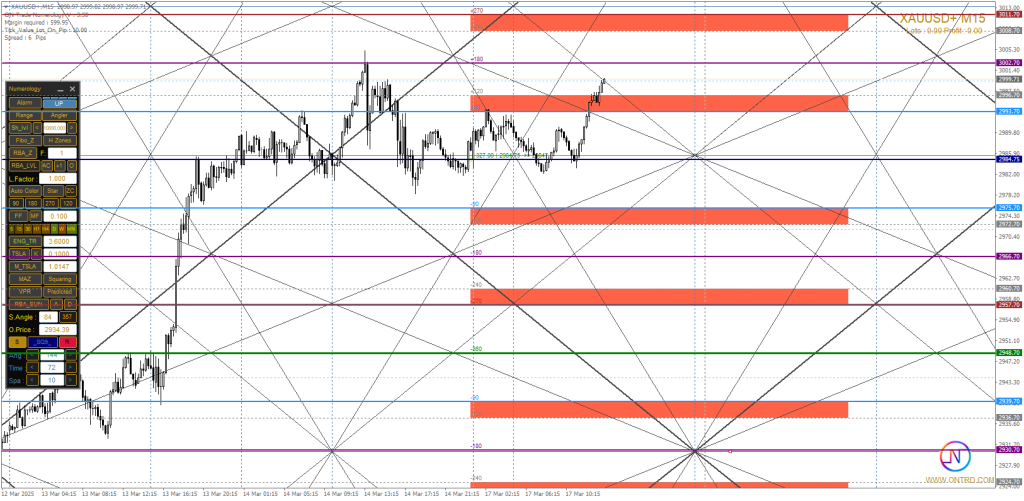

XAU/USD Chart Overview

XAUUSD Market Analysis

Recent economic events and geopolitical uncertainties continue to influence the price of gold (XAU/USD). As a safe-haven asset, XAUUSD remains in focus for investors seeking stability amid market fluctuations. The strength of the US dollar, bond yields, and global risk sentiment all play crucial roles in shaping gold’s price movements. Understanding key technical levels and potential breakout points is essential for traders navigating the XAUUSD market.

Key Support and Resistance Levels

Resistance Levels:

| Level | Price (USD) |

|---|---|

| R1 | 2993.70 |

| R2 | 3002.70 |

| R3 | 3011.70 |

Support Levels:

| Level | Price (USD) |

|---|---|

| S1 | 2984.70 |

| S2 | 2966.70 |

| S3 | 2957.90 |

Market Scenarios for Today

🔵 Bullish Scenario (Buying Opportunity)

If XAU/USD holds above the $2984.70 support level and gains momentum:

- A breakout above $2993.70 could push prices toward the $3002.70 – $3011.70 resistance zone.

- If bullish pressure continues, a strong close above $3002.70 on the M15/M30 chart may signal further upside potential.

🔹 Key Factors Supporting This Scenario:

- Weakening US dollar or declining bond yields.

- Increased geopolitical tensions driving safe-haven demand.

- Positive signals from technical indicators like RSI and MACD.

🔴 Bearish Scenario (Selling Opportunity)

If XAU/USD struggles to break above $2993.70 and faces resistance:

- A rejection at $2993.70 – $3002.70 could lead to a pullback.

- A break below $2984.70 might trigger further downside toward $2966.70.

- If selling pressure intensifies, gold could test $2957.90, and a breach of this level may accelerate losses.

🔹 Key Factors Supporting This Scenario:

- Strengthening US dollar and rising bond yields.

- Hawkish signals from the Federal Reserve regarding interest rate hikes.

- A bearish candlestick formation on lower timeframes.

Key Factors Influencing Gold Prices Today

1. Market Sentiment & Safe-Haven Demand

Gold’s status as a safe-haven asset makes it sensitive to geopolitical events and market instability. A rise in risk-off sentiment could push prices higher, while a stable market might limit upside potential.

2. US Dollar Strength & Bond Yields

A stronger dollar often puts downward pressure on gold prices. Traders closely watch the US Dollar Index (DXY) and Treasury yields for directional cues.

3. Technical Levels & Breakout Potential

- A move above $2993.70 could confirm bullish momentum toward $3002.70.

- A break below $2984.70 may indicate further downside risk, targeting $2966.70.

Economic Events Impacting Gold Prices

1️⃣ US Economic Data Releases:

- Key economic reports, such as US retail sales and inflation data, could impact gold prices. A weaker-than-expected data release may support gold, while stronger figures could pressure prices lower.

2️⃣ Federal Reserve Policy:

- Statements from Fed officials regarding future rate hikes or monetary policy shifts will be closely monitored.

3️⃣ Geopolitical Tensions & Market Risk:

- Any unexpected geopolitical developments could drive gold demand as investors seek safe-haven assets.

Gold Trading Tips for Today

📌 Best Practices for XAU/USD Traders:

- Monitor key resistance and support levels before entering trades.

- Use technical indicators (RSI, MACD) to confirm buy/sell signals.

- Set stop-loss levels to protect against market volatility.

- Follow economic news and Fed statements to anticipate price movements.

- Avoid over-leveraging and maintain a solid risk-reward strategy.

Conclusion

Gold (XAU/USD) remains at a critical juncture, with key levels defining its next move. Traders should closely watch price action around $2993.70 and $2984.70 for potential breakout or rejection signals.

Gold’s Role in Global Economic Stability

XAUUSD has always played a crucial role in the global economy, acting as both a safe-haven asset and a hedge against inflation. During periods of economic uncertainty, investors often flock to XAUUSD , driving its price higher. This is especially evident when major economies face financial instability, political turmoil, or unexpected economic downturns. Additionally, central banks worldwide hold significant gold reserves, reinforcing its value as a long-term store of wealth.

In recent years, the correlation between XAUUSD and the US dollar has been a key focus for traders. A weaker dollar tends to boost gold prices, as it becomes more affordable for international investors. Conversely, when the Federal Reserve adopts a hawkish stance, raising interest rates, gold prices often face downward pressure. Understanding these macroeconomic factors can help traders make informed decisions when analyzing XAU/USD price movements.

Furthermore, gold’s influence extends beyond just trading. It plays a vital role in industries such as jewelry, electronics, and even medical technology. This fundamental demand adds another layer of price stability, making XAUUSD an attractive asset for both short-term speculators and long-term investors.

📌 Key Takeaways:

- Bullish breakout above $2993.70 could lead to further upside toward $3002.70 – $3011.70.

- Bearish breakdown below $2984.70 might trigger downside moves toward $2966.70 – $2957.90.

- Stay updated on economic events and technical levels to make informed trading decisions.

For More Info Contact Us .

📢 For more insights, visit: