Introduction: Bitcoin Between Technical and Astrological Analysis

Bitcoin (BTC/USD) remains one of the most volatile assets in global financial markets, influenced by a combination of technical factors, economic data, and, for some traders, astrological indicators. Understanding these elements together can provide deeper insights into Bitcoin’s price movements.

Today’s analysis will cover:

- Key support and resistance levels for BTC.

- The impact of major economic events on price action.

- Technical indicators shaping market trends.

- Potential trading scenarios based on current conditions.

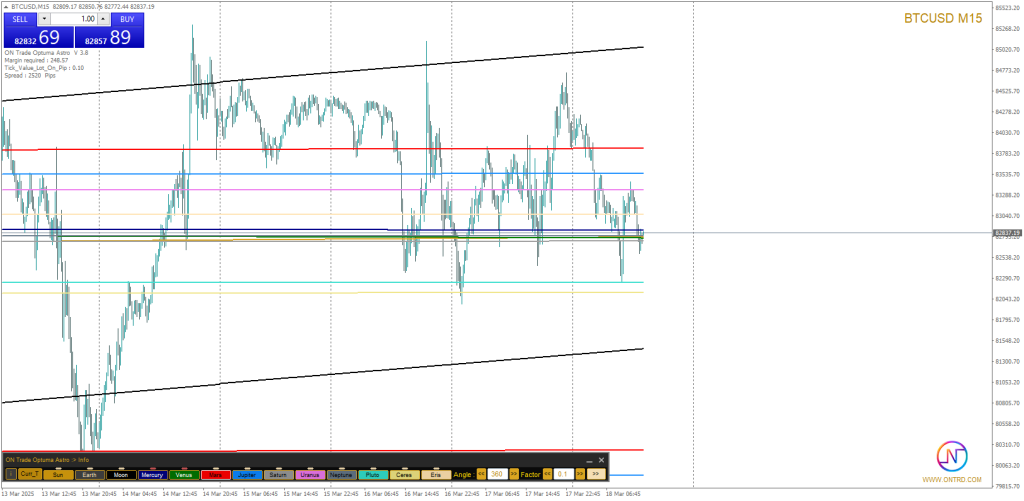

Key Support & Resistance Levels for Bitcoin

BTC is currently trading within a critical price range, where a breakout or breakdown could define its next major move.

Support Levels:

| Level | Price (USD) |

|---|---|

| S1 | 82,043 |

| S2 | 81,795 |

| S3 | 80,063 |

Resistance Levels:

| Level | Price (USD) |

|---|---|

| R1 | 83,335 |

| R2 | 83,788 |

| R3 | 85,523 |

Economic News and Its Impact on Bitcoin

Several key economic reports were released today, potentially influencing Bitcoin’s price movements.

1️⃣ CAD Inflation Data (February Report)

- Year-over-Year Inflation: Actual 1.9% (expected 2.2%) – lower-than-expected inflation could ease pressure on interest rate hikes.

- Core Inflation: 2.1% (expected 2.2%) – signals stable underlying price growth.

Impact on Bitcoin:

- Lower inflation may encourage risk-taking in financial markets, supporting BTC’s price.

- However, if inflation continues to decline, it could indicate weakening economic demand, which may limit BTC’s upside.

2️⃣ USD Housing & Industrial Production Data

- Housing Starts: 1.366M (expected 1.38M) – a decline suggests slowing housing market activity.

- Building Permits: 1.473M (expected 1.45M) – slight increase, indicating stable construction outlook.

- Industrial Production: 0.5% (expected 0.2%) – better-than-expected, suggesting strong economic output.

Impact on Bitcoin:

- Strong industrial growth supports economic resilience, which could boost investor confidence in risk assets like Bitcoin.

- Weak housing starts might signal economic slowdown, potentially causing investors to shift away from speculative assets.

3️⃣ Oil Market and Liquidity Trends

- API Crude Oil Stock Change: 4.247M (expected 1.17M) – a large inventory build suggests reduced demand for oil.

Impact on Bitcoin:

- Lower oil demand could signal an economic slowdown, reducing liquidity for risk assets.

- However, if lower oil prices ease inflation concerns, it may encourage risk-taking, benefiting BTC.

Technical Indicators to Watch for Bitcoin

Several technical indicators are shaping BTC’s price action.

- RSI (Relative Strength Index): Currently at 55, indicating a neutral stance. A move above 60 would signal strong bullish momentum.

- MACD (Moving Average Convergence Divergence): A bullish crossover is forming, suggesting potential upward momentum.

- Bollinger Bands: BTC is trading near the middle band, signaling consolidation before a potential breakout.

- 50-Day Moving Average: Positioned at 82,500, acting as an important support level.

Potential Bitcoin Trading Scenarios for Today

Bullish Scenario: Breakout Towards $85,000+

If BTC holds above 82,837, a breakout above 83,335 could push prices toward 83,788 – 85,523 in the coming days.

Key Conditions for This Scenario:

- Price remains stable above 82,837 (critical pivot point).

- A confirmed breakout above 83,335 with strong buying volume.

- Weakening US dollar due to economic data or dovish Federal Reserve policies.

Target Levels:

- 83,788 (next major resistance).

- 85,523 (longer-term target if momentum continues).

Supporting Factors:

- Lower-than-expected inflation encourages risk appetite.

- Strong industrial production suggests economic resilience.

- Bullish technical indicators, including MACD crossover and RSI strength.

Bearish Scenario: Breakdown Towards $80,000

If BTC fails to maintain support at 82,043, a decline toward 81,795 – 80,063 could occur.

Key Conditions for This Scenario:

- Bitcoin struggles to break above 83,335 and faces rejection.

- Price falls below 82,043, signaling increasing selling pressure.

- Economic concerns trigger a risk-off sentiment, leading investors to sell BTC.

Target Levels:

- 81,795 (first major support).

- 80,063 (potential downside target).

Supporting Factors:

- Weak housing market data could signal slowing economic activity.

- Large crude oil inventory build suggests declining demand, impacting overall liquidity.

- Bearish technical patterns, including a failure to break key resistance.

Bitcoin Pivot Points for March 18, 2025

| Level | Price (USD) |

|---|---|

| Pivot Point | 82,500 |

| Bullish Breakout Above | 83,335 |

| Bearish Breakdown Below | 81,795 |

The pivot point at 82,500 is crucial for determining BTC’s short-term trend. A move above this level favors bullish momentum, while a drop below it may trigger further downside pressure.

Astrological Insights & Market Timing

Astrological cycles have been historically linked to shifts in financial markets. Several planetary influences may impact Bitcoin’s movement.

- Jupiter in Aries: Encourages expansion and risk-taking, potentially supporting bullish sentiment.

- Saturn Retrograde: Signals a period of caution and regulatory discussions, which could introduce uncertainty.

- Full Moon Effect (March 25, 2025): Historically, full moons coincide with high volatility in Bitcoin prices. Traders should be prepared for sharp market swings.

Final Thoughts: What’s Next for Bitcoin?

Bitcoin is currently at a decisive point, with price action heavily influenced by economic data, technical signals, and astrological trends.

Key Takeaways for Traders:

- 82,500 is the pivot level – watch for price action around this zone.

- Monitor macroeconomic reports, particularly inflation and liquidity trends.

- Align trading strategies with technical and astrological signals to maximize risk management.

Bitcoin’s price direction will largely depend on whether it can hold above support levels and break through resistance barriers. Traders should remain flexible and ready to adjust their strategies based on market conditions.

Stay updated for further insights you can contact us .

Check Also :