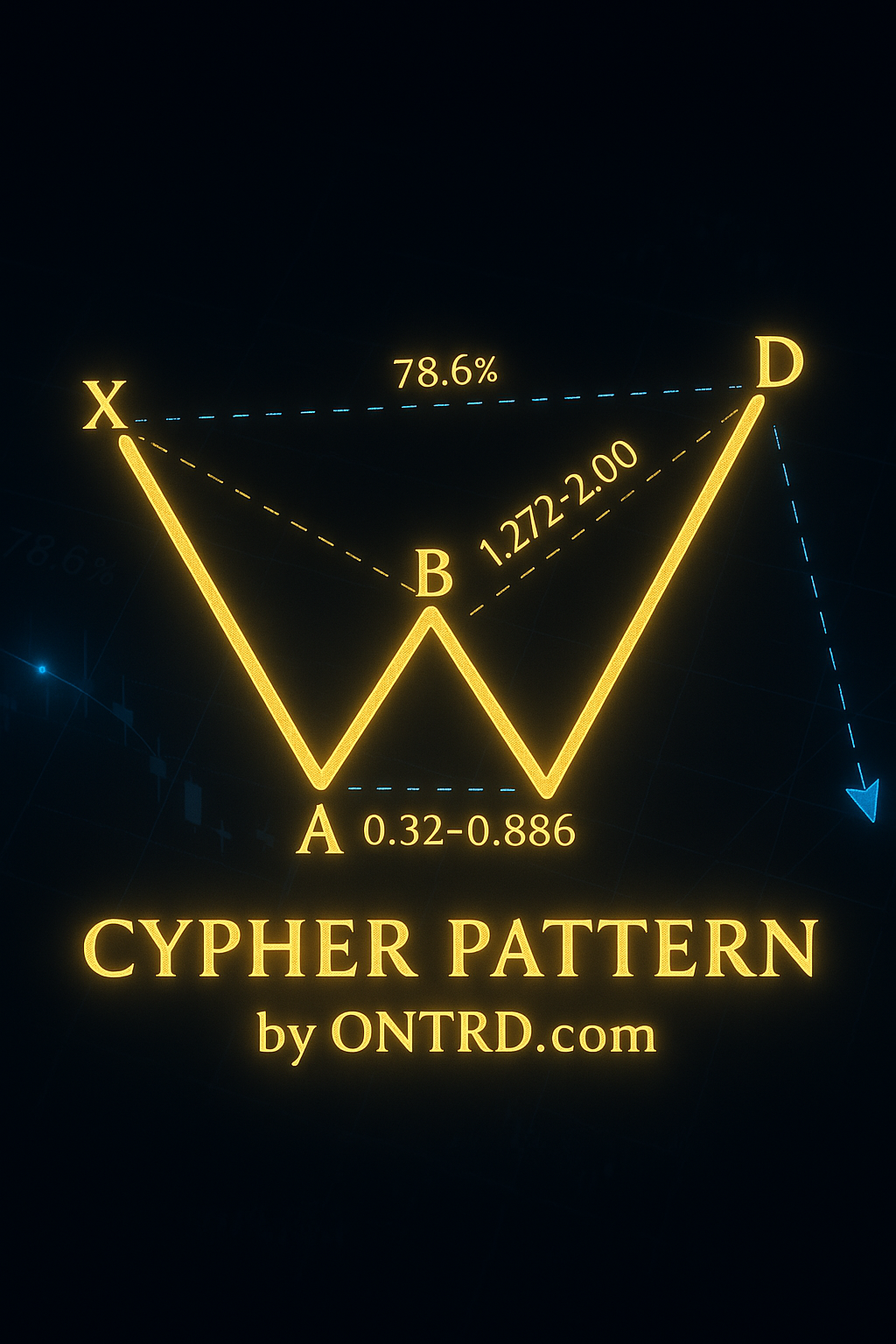

The Cypher harmonic pattern is one of the most advanced and reliable harmonic patterns, known for its strong reversal signals and precise Fibonacci ratios. Developed by Darren Oglesbee, this pattern helps traders identify potential market turning points with exceptional accuracy.

🔑 Key Features:

✔ Unique 5-point structure (X-A-B-C-D)

✔ Precise Fibonacci ratios for high-probability entries

✔ Works across all markets (Forex, stocks, crypto) and timeframes

✔ Provides clear stop loss and take profit levels

1. Origins of the Cypher Pattern

- Developer: Darren Oglesbee (2000s)

- Name Origin: The pattern’s complex structure resembles a “cypher” or code

- Key Innovation: Uses unique Fibonacci ratios not found in other harmonic patterns

2. Cypher Pattern Structure & Fibonacci Ratios

Pattern Points (X-A-B-C-D)

| Leg | Fibonacci Requirement |

|---|---|

| AB | 38.2% – 61.8% of XA |

| BC | 113% – 141.4% of AB |

| CD | 78.6% of XC (Must reach 127.2% – 2.0% of BC) |

Bullish vs. Bearish Cypher

- Bullish Cypher: Forms at market bottoms (Buy at D)

- Bearish Cypher: Forms at market tops (Sell at D)

3. How to Trade the Cypher Pattern (Step-by-Step)

Step 1: Identify XA Impulse Move

- Look for strong directional price movement

Step 2: AB Retracement (38.2% – 61.8%)

- Must retrace within this Fibonacci range

Step 3: BC Extension (113% – 141.4%)

- Should extend beyond point A

Step 4: CD Retracement (Critical 78.6%)

- Must retrace 78.6% of XC

- Should reach 127.2% – 2.0% of BC

Step 5: Enter at Point D

- Buy (Bullish Cypher) or Sell (Bearish Cypher) with confirmation

4. Stop Loss & Take Profit Rules

Stop Loss Placement

- Bullish Cypher: Below point D

- Bearish Cypher: Above point D

Take Profit Targets

| Target | Fibonacci Level |

|---|---|

| TP1 | 38.2% of AD |

| TP2 | 61.8% of AD |

| TP3 | 100% of AD |

5. Confirmation Signals (Increase Accuracy)

✔ Price Action: Reversal candles (pin bars, engulfing patterns) at point D

✔ RSI/MACD Divergence

✔ Volume Analysis: Increased volume at reversal point

✔ Trendline/Support-Resistance Confluence

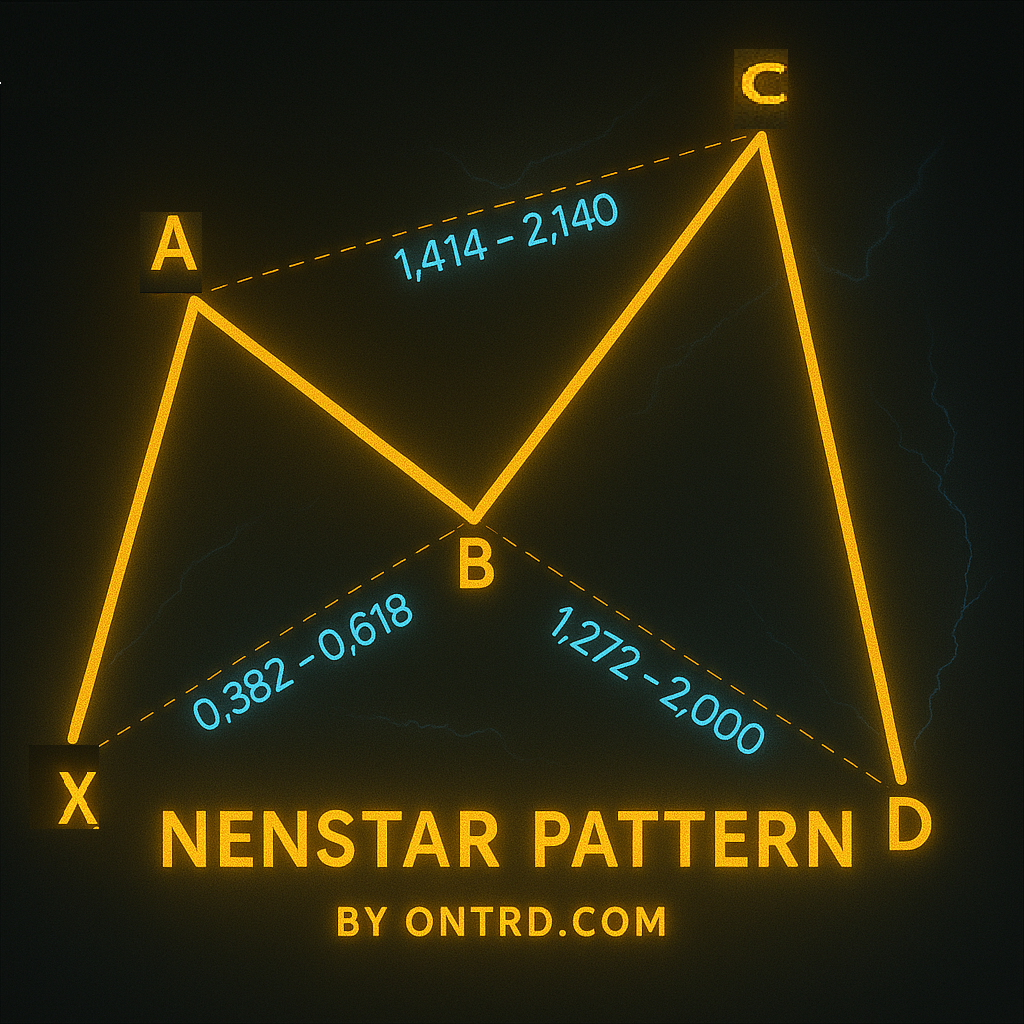

6. Cypher vs. Other Harmonic Patterns

| Feature | Cypher Pattern | Butterfly Pattern | Bat Pattern |

|---|---|---|---|

| Structure | 5-point (XABCD) | 5-point (XABCD) | 5-point (XABCD) |

| BC Leg | 113%-141.4% AB | 38.2%-88.6% AB | 38.2%-88.6% AB |

| Accuracy | Very High | High | High |

| Frequency | Moderate | Rare | Common |

7. Frequently Asked Questions (FAQs)

Q1: Why is the Cypher pattern so effective?

A: Its unique BC extension and CD retracement create extremely precise reversal zones.

Q2: Best markets for Cypher pattern?

A: Works exceptionally well in Forex (EUR/USD, GBP/USD), stocks (AAPL, TSLA), and crypto (BTC, ETH).

Q3: How to avoid false Cypher patterns?

A: Always wait for price confirmation at D point and check for RSI divergence.

Q4: Cypher vs. Gartley pattern – which is better?

A: Cypher offers stronger reversals but requires more precise Fibonacci ratios.

8. Professional Trading Tips

- Be patient – True Cypher patterns are rare but high-quality

- Combine with trend analysis – Works best when aligned with higher timeframe trend

- Use partial profits – Take 50% at TP1, move stop to breakeven

- Practice on historical charts before trading live

9. Conclusion

The Cypher harmonic pattern is a powerful tool for spotting high-probability market reversals. Key takeaways:

✅ BC must extend 113%-141.4% of AB

✅ CD must retrace 78.6% of XC

✅ Always use confirmation signals

✅ Works across all timeframes and markets

✅ Be careful at Economic News Times .

🚀 For best results, combine Cypher patterns with other technical analysis tools for confluence.

- You can depend on best indicator to detect harmonic patterns by using ON Trade Waves Patterns

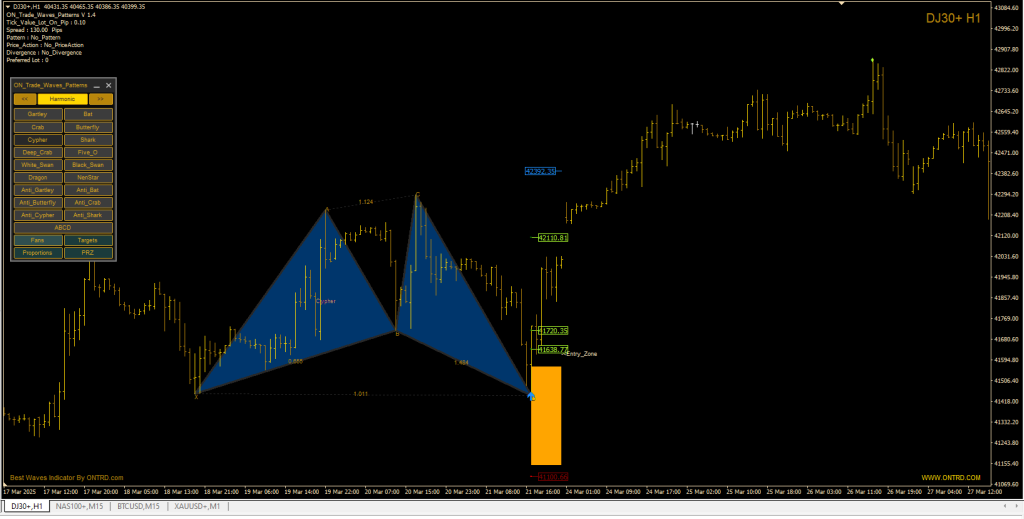

Example :