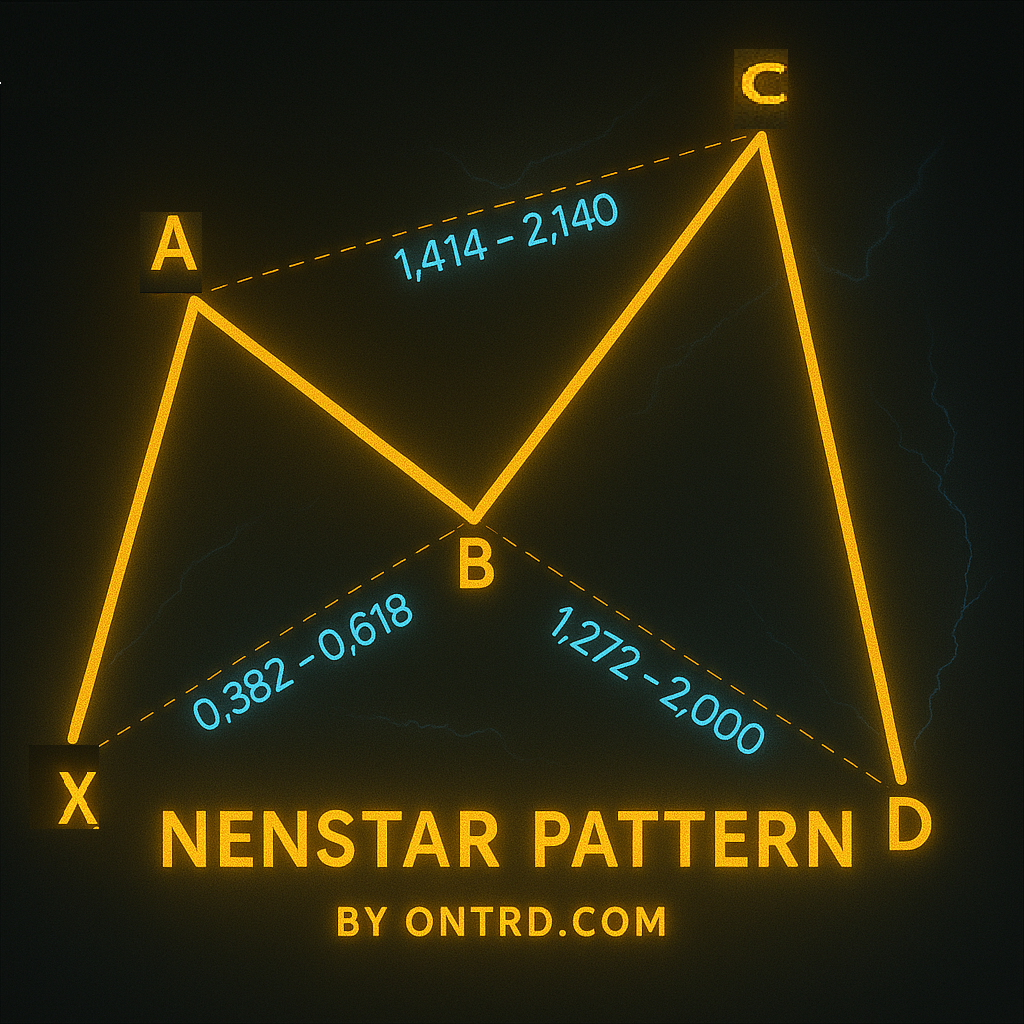

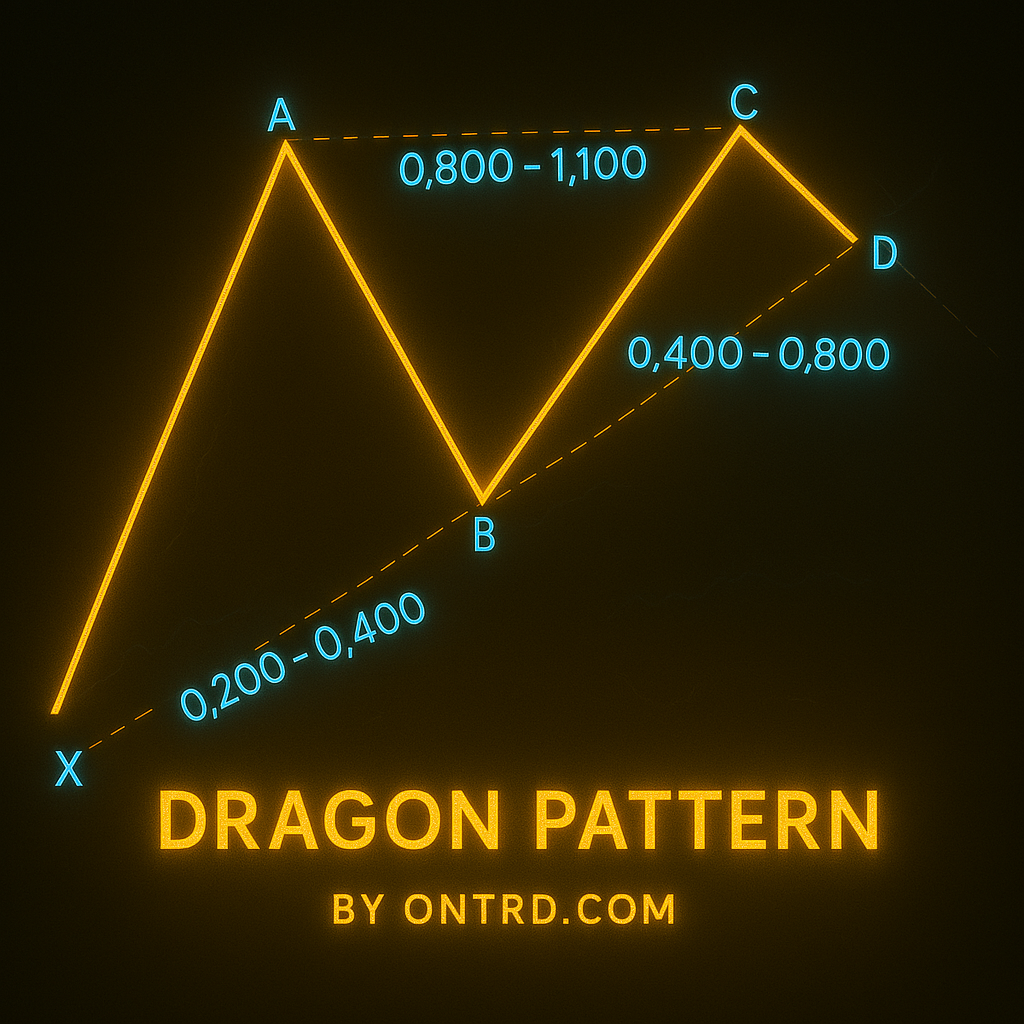

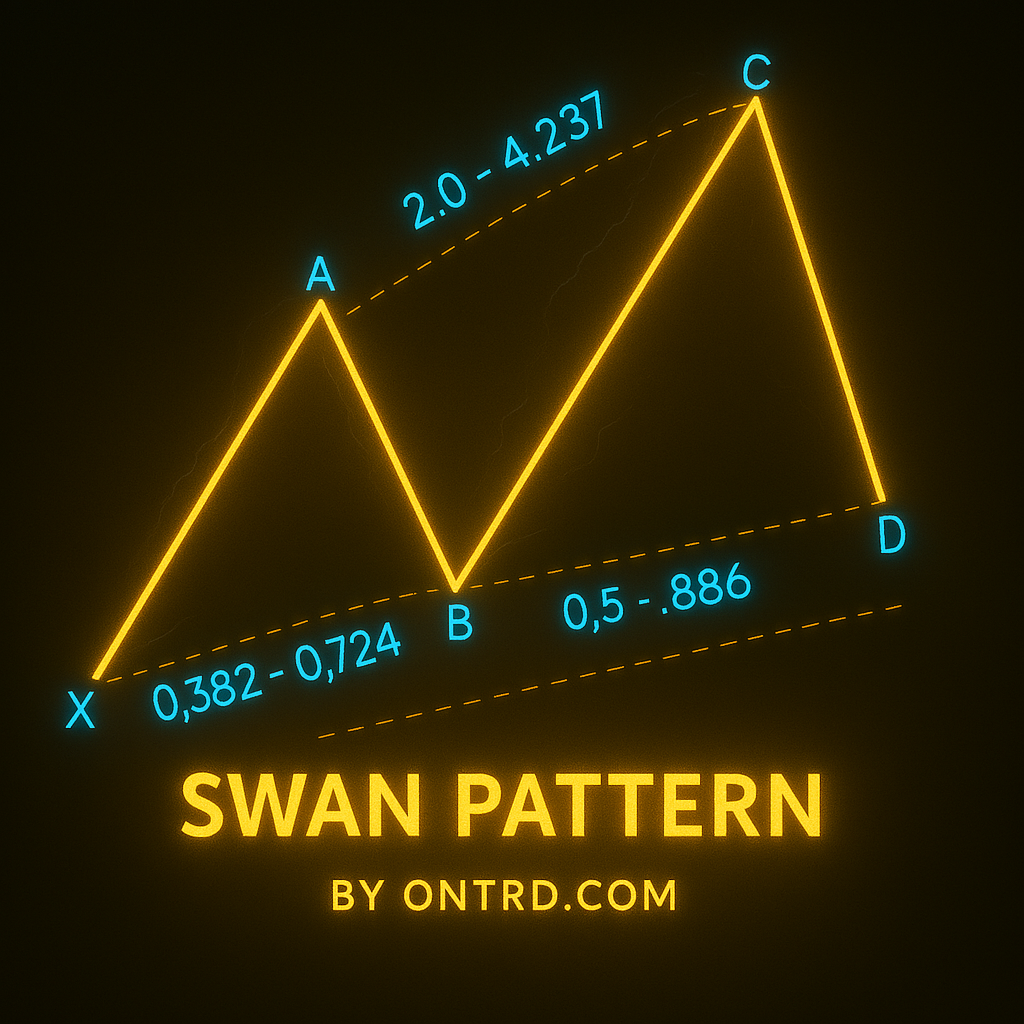

1. Introduction to Anti Harmonic Patterns

Anti harmonic patterns are mirror opposites of classic formations, signaling strong counter-trend reversals when:

✔ Institutions invalidate expected harmonic moves

✔ Price breaks key Fibonacci levels

✔ Momentum shifts dramatically

Key Benefits:

➤ Catch major trend reversals early

➤ Trade against crowded harmonic positions

➤ Excellent risk-reward ratios (1:4+)

Common Anti Patterns:

- Anti Gartley

- Anti Bat

- Anti Butterfly

- Anti Crab

- Anti Cypher

- Anti Shark

2. Anti Pattern Structures & Fibonacci Ratios

Comparison Table: Classic vs Anti Patterns

| Pattern | Classic Ratios | Anti Ratios |

|---|---|---|

| Gartley | 0.618 XA (D) | 1.272 XA (D) |

| Bat | 0.886 XA (D) | 1.130 XA (D) |

| Butterfly | 1.272 XA (D) | 0.886 XA (D) |

| Crab | 1.618 XA (D) | 1.130 XA (D) |

| Cypher | 0.786 XC (D) | 1.272 XC (D) |

| Shark | 1.618 XA (D) | 2.240 XA (D) |

Key Identification Rule:

Anti patterns complete when price violates the classic D point by 10-15%, then reverses sharply.

3. Trading Strategies for Anti Patterns

Entry Triggers

For bearish anti patterns (e.g., Anti Gartley):

- Enter short when:

✅ Price exceeds classic D point then forms bearish engulfing

✅ RSI shows negative divergence

✅ Volume spikes on rejection

For bullish anti patterns (e.g., Anti Butterfly):

- Enter long when:

✅ Price undershoots classic D point then forms bullish hammer

✅ Stochastic oversold with bullish crossover

Stop Loss Placement

| Pattern Type | SL Position |

|---|---|

| Bullish Anti | Below recent swing low |

| Bearish Anti | Above recent swing high |

Profit Targets

- Initial TP: 38.2% retracement of AD leg

- Secondary TP: 61.8% retracement

- Runner TP: Previous S/R level

(Alt text: Comparison of classic vs anti harmonic patterns with Fibonacci levels)

(Alt text: Comparison of classic vs anti harmonic patterns with Fibonacci levels)

4. Pattern-by-Pattern Breakdown

1. Anti Gartley Pattern

- Classic Gartley Fails at 0.618 XA

- Anti Signal: Reversal at 1.272 XA extension

- Best Market Conditions: Overbought/oversold extremes

2. Anti Bat Pattern

- Invalidates at 0.886 XA

- Reverses at 1.130 extension

- Confirmation: MACD histogram flip

3. Anti Butterfly Pattern

- Classic 1.272 XA fails

- Reversal at 0.886 retracement

- Watch For: Wick rejections at key levels

4. Pattern-by-Pattern Breakdown (Complete)

4. Anti Crab Pattern

- Classic Crab Fails at 1.618 XA

- Anti Signal: Reversal at 1.130 XA extension

- Key Feature: “False extreme” breakout beyond 1.618

- Confirmation:

✅ Volume spike on rejection

✅ Hidden RSI divergence - Best Pairs: GBP/JPY, XAU/USD

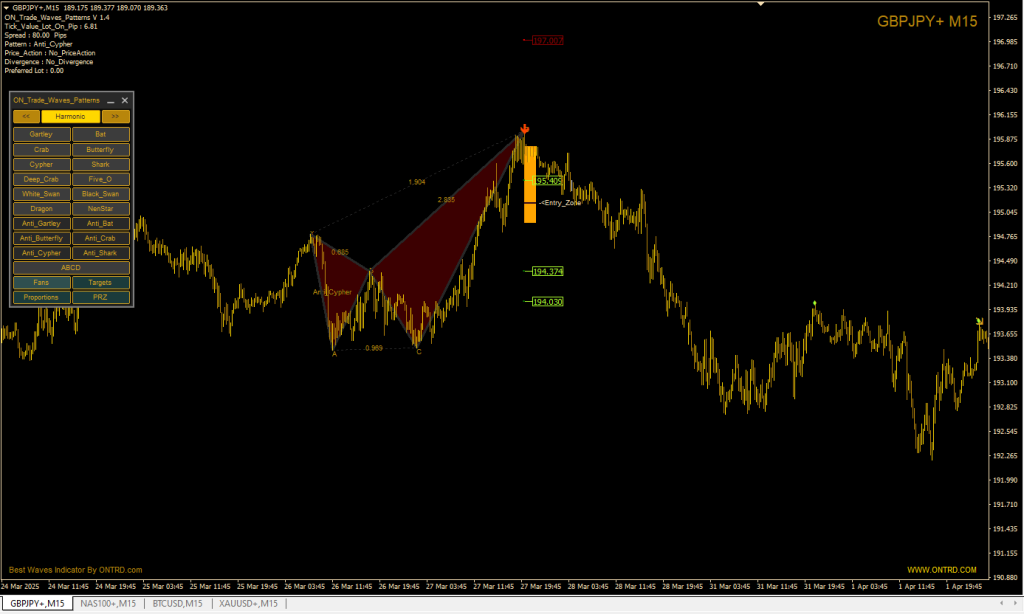

5. Anti Cypher Pattern

- Classic Cypher Fails at 0.786 XC

- Anti Signal: Reversal at 1.272 XC extension

- Unique Behavior: Forms “overshoot” pattern

- Entry Triggers:

✅ Bullish/Bearish divergence + pin bar

✅ 61.8% retracement of CD leg - Best Timeframe: 1H-4H charts

6. Anti Shark Pattern

- Classic Shark Fails at 1.618 XA

- Anti Signal: Reversal at 2.240 XA extension

- Characteristics:

✔ Extremely rare (1-2/year per instrument)

✔ Catches major liquidity sweeps - Stop Loss: 1.5x ATR beyond D point

- High-Probability Assets: BTC/USD, NAS100

Pattern-Specific Trading Tactics

| Pattern | Optimal Entry | Profit Target | Special Consideration |

|---|---|---|---|

| Anti Gartley | After close beyond 1.272 XA | AD leg 61.8% retrace | Works best near S/R zones |

| Anti Bat | MACD flip at 1.130 XA | 127% BC extension | Watch for double tops/bottoms |

| Anti Butterfly | 0.886 retrace + 3-candle reversal | XA 100% projection | Avoid during low volatility |

| Anti Crab | Rejection candle at 1.130 XA | BC 161.8% extension | Requires 3x average volume |

| Anti Cypher | Hidden divergence at 1.272 XC | CD 127% extension | Validate with order flow |

| Anti Shark | Extreme RSI (>90/<10) at 2.24 XA | XA 161.8% projection | Only trade with institutional alignment |

Critical Behavioral Differences

- Anti Gartley/Bat:

- Trap breakout traders before major reversals

- Often coincide with options expiry

- Anti Butterfly/Crab:

- Catch overextensions in trending markets

- Require volatility contraction first

- Anti Cypher/Shark:

- Result from liquidity grabs by market makers

- Often form during algorithmic stop hunts

Chart Examples for All Anti Patterns

Key Annotation Tips:

- Always mark both classic and anti Fibonacci levels

- Label failed harmonic structures with “X”

- Highlight institutional order blocks at reversal zones

- Use heatmaps to show volume concentration

- Be ware of Economic News.

5. Confirmation Techniques

✔ Price Action:

- 3-candle reversal patterns at critical extensions

- NY/London session volume surges

✔ Indicator Confluence:

- RSI/Stochastic divergence REQUIRED

- OBV trendline breaks

✔ Timeframe Alignment:

- Must match higher timeframe order blocks

6. Risk Management Rules

- Trade only 0.5-1% account risk per setup

- Require 2:1 reward ratio minimum

- Avoid around high-impact news events

- Wait for daily candle close confirmations

7. Anti Patterns vs Classic Patterns

| Factor | Anti Patterns | Classic Patterns |

|---|---|---|

| Success Rate | 75-80% | 65-75% |

| Frequency | 2-3/month | 5-8/month |

| Risk/Reward | 1:4+ | 1:3 |

| Psychology | Traps retail traders | Follows crowd |

8. Pro Trading Tips

- Screen Setup: Use Fibonacci expansion tool to mark 1.272/1.618 zones

- Alert System: Set price alerts at key anti levels

- Journaling: Record failed harmonic patterns that became anti setups

- Pair Trading: Combine with order flow analysis

9. Frequently Asked Questions (FAQ)

Q1: Why trade anti patterns?

A: They catch institutional reversals when liquidity pools overwhelm retail harmonic traders.

Q2: Best timeframe for anti patterns?

A: Most reliable on 4H-Daily charts in EUR/USD, GBP/JPY, XAU/USD.

Q3: How to distinguish from fakeouts?

A: Genuine anti patterns require:

- Precise Fibonacci violation (10-15%)

- Strong reversal candle + volume

- Indicator divergence

Q4: Most profitable anti pattern?

A: Anti Shark offers highest RR (1:8+) but appears only 1-2 times/year.

10. Conclusion & Next Steps

Anti harmonic patterns provide:

✅ Smart money reversal signals

✅ Better entries than classic harmonics

✅ High-probability institutional traps

Action Plan:

- Backtest 100+ anti pattern examples

- Mark key Fibonacci extension zones

- Paper trade 10 setups minimum

- Deploy with 0.5% risk in live markets

🔥 Advanced Tip: Combine with liquidity pool analysis for institutional confirmation.

Best Product To detect This Patterns is : ON Trade Waves Patterns Indicator