1. Introduction to the Five O Harmonic Pattern

The Five O Harmonic Pattern is a powerful trend continuation pattern first identified by Scott Carney. Unlike most harmonic patterns that predict reversals, the 5-0 helps traders:

✔ Identify strong trend resumptions

✔ Spot high-probability continuation entries

✔ Capitalize on extended market moves

✔ Trade with precise Fibonacci measurements

Unique Feature: The pattern completes at point “0” (zero), giving it the distinctive “5-0” name.

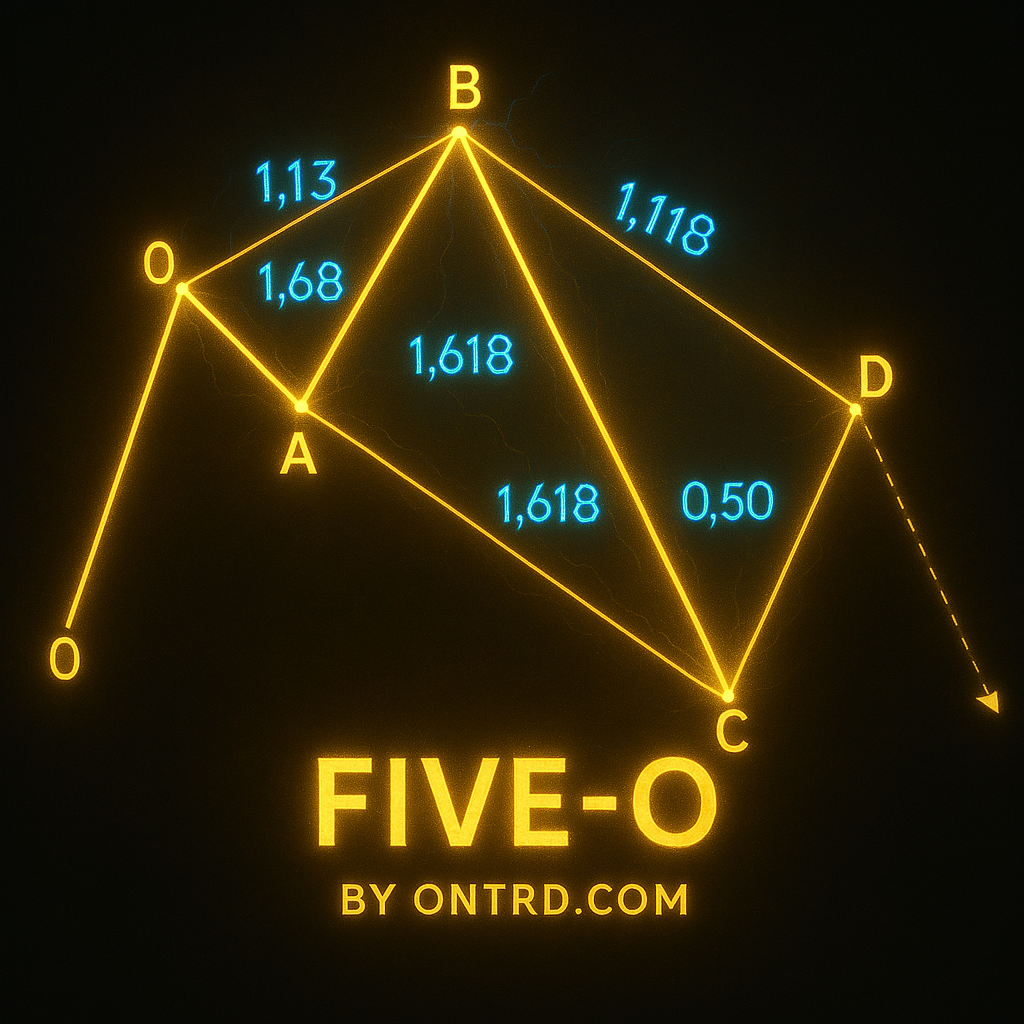

2. Pattern Structure & Key Fibonacci Ratios

The Five O Harmonic Pattern follows a 5-point structure (X-A-B-C-D-0) with these critical Fibonacci relationships:

| Wave | Fibonacci Requirement | Trading Significance |

|---|---|---|

| AB | 113%-161.8% of XA | Initial extension |

| BC | 161.8%-224% of AB | Deep retracement |

| CD | 0.5%% of BC | Secondary extension |

| XD | 0.113%-0.23% of XA | Continuation entry zone |

Bullish vs. Bearish Five O Harmonic Pattern

- Bullish Five O Harmonic Pattern: Forms in uptrends (Buy at 0)

- Bearish Five O Harmonic Pattern: Forms in downtrends (Sell at 0)

3. Step-by-Step Identification Five O Harmonic Pattern Guide

- Identify XA Wave: Strong initial trend move

- Measure AB Extension: Must be 113%-161.8% of XA

- Track BC Retracement: Should be 161.8%-224% of AB

- Confirm CD Extension: 0.5 of BC

- Spot D Point: At 0.133%-0.23% of XA

Visual Tip: The pattern forms a “lightning bolt” shape on charts, with the 0 point acting as the continuation trigger.

4. Trading Strategy & Execution

Optimal Entry Points

- Enter long/short at 0 point with confirmation:

- Bullish: Strong candle closing above 0

- Bearish: Strong candle closing below 0

Stop Loss Placement

| Pattern Type | Stop Loss Position |

|---|---|

| Bullish Five O Harmonic Pattern | Below recent swing low |

| Bearish Five O Harmonic Pattern | Above recent swing high |

Take Profit Targets

| Target | Fibonacci Level | Action |

|---|---|---|

| TP1 | 61.8% of CD | Take 50% profit |

| TP2 | 100% of CD | Take 30% profit |

| TP3 | 161.8% of CD | Close remaining |

5. Confirmation Techniques for Higher Accuracy

✔ Price Action:

- Bullish: Engulfing pattern at 0 point

- Bearish: Dark cloud cover at 0 point

✔ Indicator Confluence:

- ADX > 25 confirming strong trend

- MACD crossing signal line

✔ Volume Analysis:

- Increasing volume at pattern completion

✔ Timeframe Alignment:

- Confirm with higher timeframe trend direction

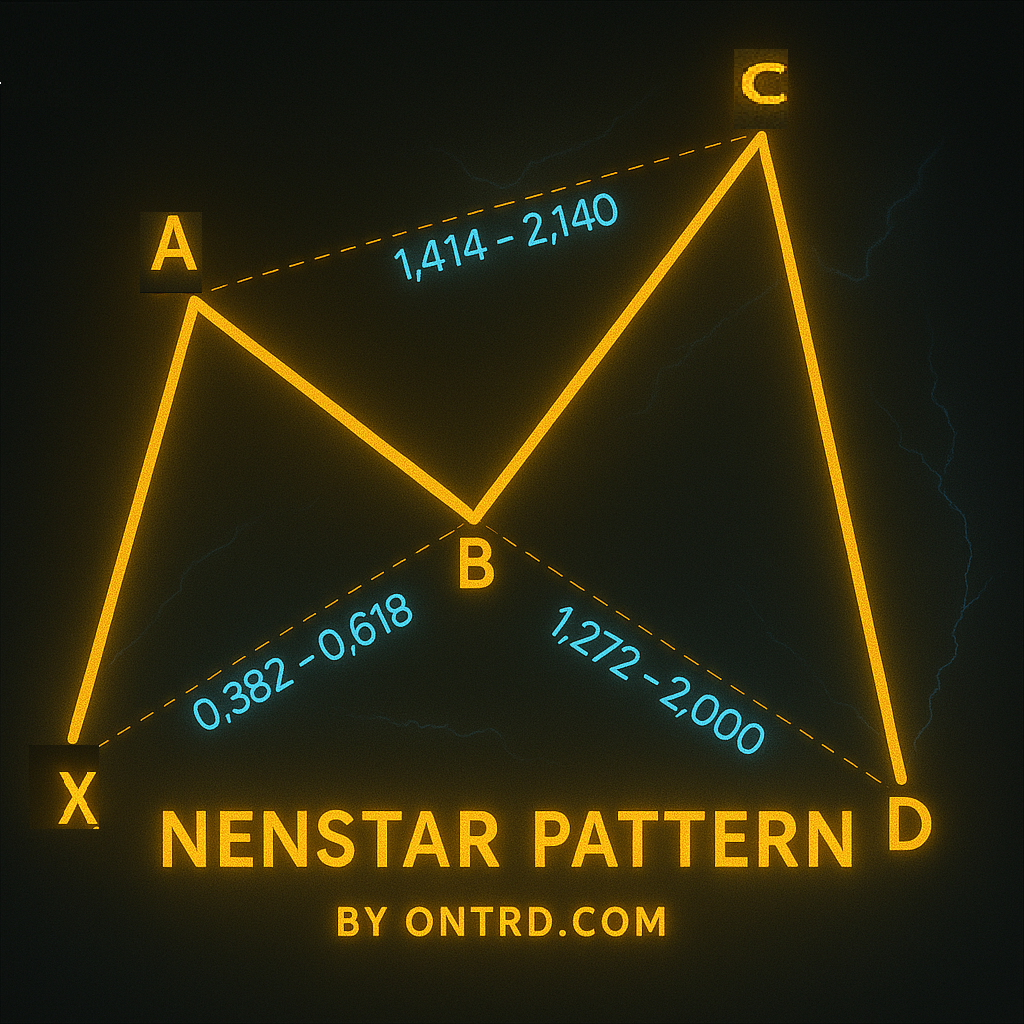

6. 5-0 vs. Other Harmonic Patterns

| Feature | 5-0 Pattern | Crab Pattern |

|---|---|---|

| Purpose | Continuation | Reversal |

| Completion | 0 point | D point |

| Risk/Reward | 1:3+ potential | 1:2 typical |

| Frequency | Moderate | Common |

7. Professional Trading Tips

- Trend is Your Friend: Only trade 5-0 in direction of larger trend

- Wait for Confirmation: Never enter before 0 point completion

- News Awareness: Avoid around major economic releases

- Backtesting Essential: Test on 100+ examples

- Position Sizing: 1-2% risk per trade maximum

- Be ware of Economic News.

8. Frequently Asked Questions (FAQ)

Q1: Why is the 5-0 pattern so effective for continuations?

A: The extreme Fibonacci extensions create exhaustion points where trends typically resume.

Q2: Best markets for 5-0 patterns?

A: Works exceptionally well in Gold (XAU/USD), EUR/USD, and BTC/USD.

Q3: How to avoid false signals?

A: Require:

- Precise Fibonacci ratios

- Strong trend background

- Volume confirmation

Q4: Optimal timeframes?

A: Most reliable on Daily and 4H charts.

9. Conclusion & Next Steps

The Five O Harmonic Pattern provides traders with:

✅ High-probability continuation signals

✅ Excellent risk-reward opportunities

✅ Clear structural rules

Recommended Action Plan:

- Study 30+ historical examples

- Paper trade for 2 weeks

- Develop personal confirmation checklist

- Start live trading with small sizes

🚀 Pro Tip: Combine with moving averages for trend confirmation.

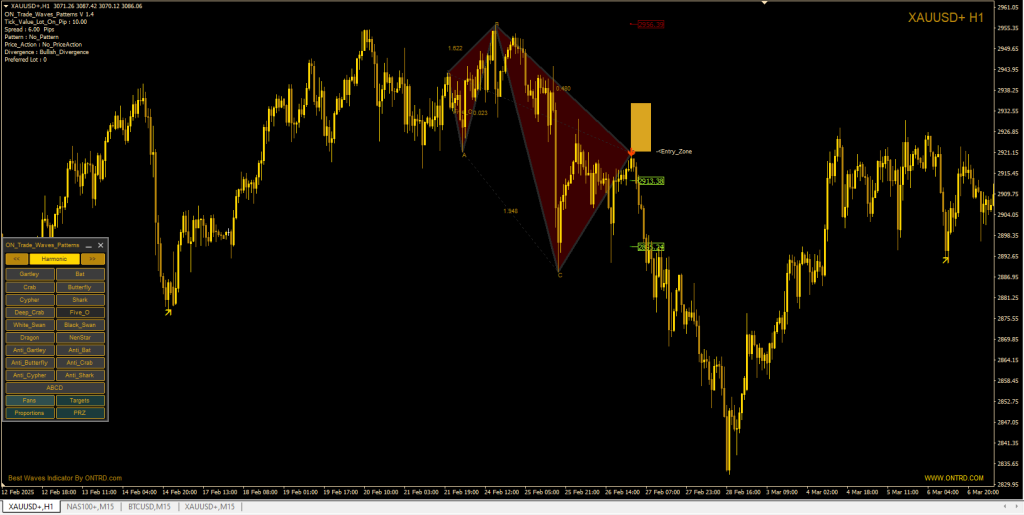

Best Product To detect Harmonic Patterns is : ON Trade Waves Patterns

Example :