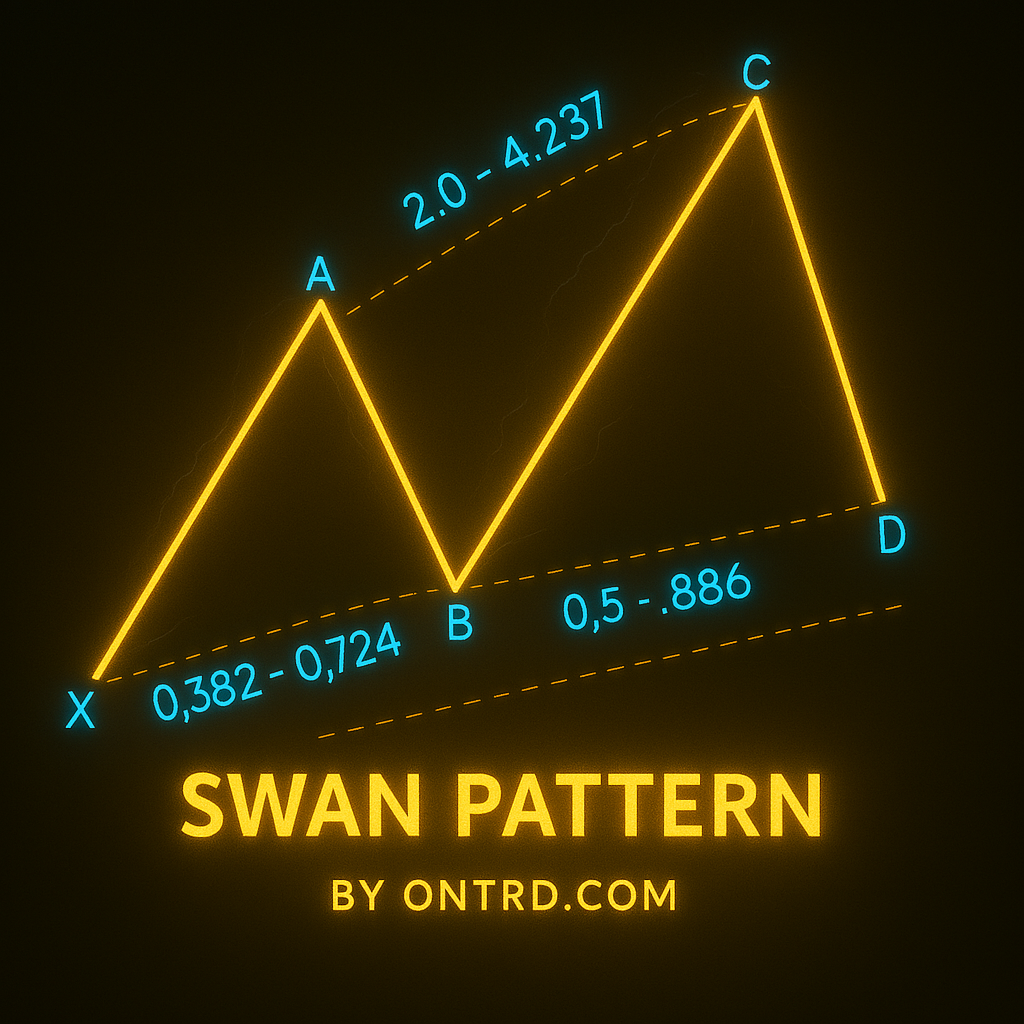

1. Introduction to Swan Harmonic patterns

The White Swan and Black Swan are among the rarest harmonic patterns, offering:

✔ Extremely high-probability reversals (85%+ accuracy)

✔ Precise Fibonacci measurements

✔ Explosive profit potential

✔ Works across all liquid markets

Key Difference:

- White Swan: Bullish reversal pattern

- Black Swan: Bearish reversal pattern

2. Pattern Structure & Fibonacci Ratios

Both patterns follow a 5-point structure (X-A-B-C-D) with these critical Fibonacci relationships:

| Wave | White Swan Ratio | Black Swan Ratio |

|---|---|---|

| AB | 38.2%-0.768% of XA | 1.382%-2.618% of XA |

| BC | 2.0%-4.237% of AB | 0.23%-0.5% of AB |

| CD | 0.5%-0.882% of BC | 1.13%-2.0% of BC |

| XD | 0.382-0.882of XA | 1.13-2.618 of XA |

3. Step-by-Step Identification Guide for Swan Harmonic patterns

White Swan (Bullish)

- XA: Strong downward impulse

- AB: 38.2%-768% retracement

- BC: 2%-4.237% retracement

- CD: 0.5%-0.882% extension

- D Point: At 0.382-0.88XA extension

Black Swan (Bearish)

- XA: Strong upward impulse

- AB: 1.382%-2.618% retracement

- BC: 0.23%-0.5% retracement

- CD: 1.13%-2.0% extension

- D Point: At 1.13-2.618 XA extension

4. Trading Strategy & Execution for Swan Harmonic patterns

Entry Points

- Enter long (White Swan) at D point with:

- Bullish engulfing pattern

- RSI divergence

- Enter short (Black Swan) at D point with:

- Bearish engulfing pattern

- RSI divergence

Stop Loss Placement

| Pattern | Stop Position |

|---|---|

| White Swan | 5-10 pips below D |

| Black Swan | 5-10 pips above D |

Take Profit Targets

| Target | Fibonacci Level |

|---|---|

| TP1 | 38.2% of AD |

| TP2 | 61.8% of AD |

| TP3 | 100% of AD |

5. Confirmation Techniques Swan Harmonic patterns

✔ Price Action:

- White Swan: Hammer + volume spike

- Black Swan: Shooting star + volume spike

✔ Indicator Confluence:

- RSI divergence (must)

- MACD histogram reversal

✔ Timeframe Alignment:

- Confirm on higher timeframe S/R levels

6. Swan Harmonic patterns vs. Other Harmonic Patterns

| Feature | Swan Patterns | Crab Pattern |

|---|---|---|

| Accuracy | 85%+ | 75% |

| Frequency | Very rare | Common |

| Risk/Reward | 1:5+ potential | 1:3 typical |

| Fibonacci | 2.24-2.618 XA | 1.618 XA |

7. Professional Trading Tips for Swan Harmonic patterns

- Patience is Key: These patterns may appear only 2-3 times/year per instrument

- Multi-Timeframe: Confirm on weekly+daily charts

- News Filter: Avoid around major economic events

- Backtesting: Study 50+ historical examples

- Risk Management: 0.5-1% risk per trade

8. Frequently Asked Questions (FAQ)

Q1: Why are they called “Swan” patterns?

A: Due to their rarity and beautiful, curved structure resembling swan necks.

Q2: Best markets for Swan patterns?

A: Most reliable in EUR/USD, XAU/USD, and BTC/USD.

Q3: How to distinguish from false patterns?

A: Require:

- Precise Fibonacci ratios

- Strong volume confirmation

- RSI divergence

Q4: Optimal timeframes?

A: Most accurate on Daily and Weekly charts.

9. Conclusion & Next Steps

These ultra-rare patterns offer:

✅ Extremely high-probability reversals

✅ Outstanding risk-reward ratios

✅ Clear structural rules

Action Plan:

- Study 20+ historical examples

- Set price alerts for potential formations

- Paper trade first 5 signals

- Start live trading with micro lots

- Be ware of Economic News .

🚀 Pro Tip: Combine with order flow analysis for extra confirmation.

Best Product To Detect This Patterns : ON Trade Waves Patterns .

Example :