In-depth Introduction to Bitcoin Technical Analysis

Bitcoin continues to dominate the global financial scene with exciting price movements that attract investors and traders alike. Today’s BTCUSD technical analysis offers an in-depth view of the current price trends with a clear definition of support and resistance levels, along with a detailed study of the Relative Strength Index (RSI), Moving Averages (MAs), and MACD indicators. This comprehensive report aims to equip readers with strong trading insights and reliable data to base their investment decisions on the latest BTCUSD trends.

Bitcoin Price Technical Analysis

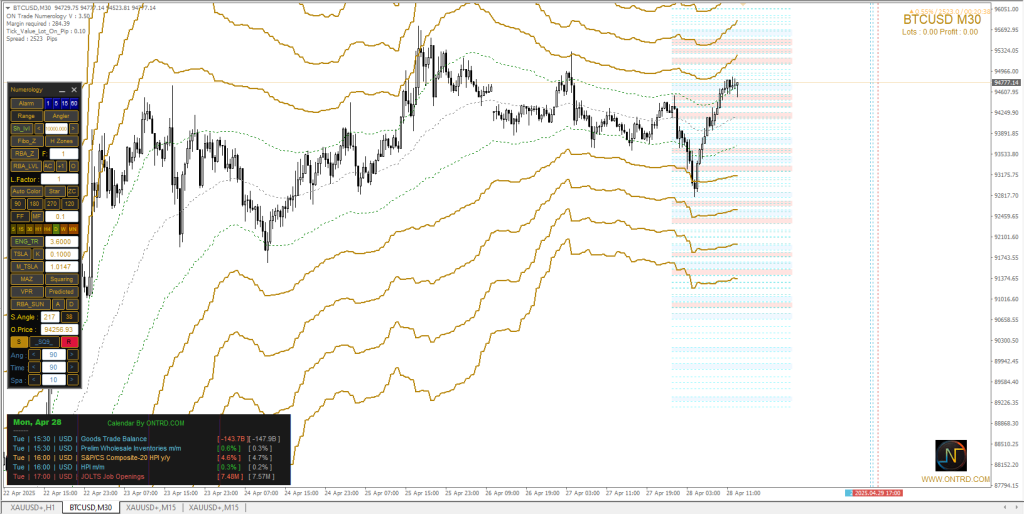

- Current Price: $94,724

- Trend Direction: Strongly bullish with clear positive momentum

Bitcoin witnessed a sharp bullish reversal after testing strong support zones, boosting confidence in the current upward trend. The price has surpassed several minor resistance levels, increasing the probability of further upward movement in upcoming sessions.

Detailed Technical Insight into RSI, MACD, and Moving Averages

Relative Strength Index (RSI): The RSI is hovering above 60, indicating strong bullish momentum. Should it break above 70, we might witness additional price gains before any significant correction.

MACD Indicator: A clear bullish crossover is observed, with the MACD line widening away from the signal line, suggesting robust positive momentum and a continuation of the upward trend.

Moving Averages: The price is consistently moving above the short-term, medium-term, and long-term moving averages, confirming that bulls firmly control the trend.

Comprehensive Explanation of Support Levels

Support levels are crucial zones where selling pressure could ease, allowing prices to rebound. Bitcoin support levels are vital for strategizing entry points and risk management.

| Support Level | Price (USD) |

|---|---|

| First Support | 93,891 |

| Second Support | 93,175 |

| Third Support | 92,459 |

| Fourth Support | 91,743 |

Comprehensive Explanation of Resistance Levels

Resistance levels act as potential barriers that could halt or reverse price advances due to increased selling pressure. Identifying them helps in planning exits or adding positions upon breakouts.

| Resistance Level | Price (USD) |

|---|---|

| First Resistance | 94,607 |

| Second Resistance | 94,956 |

| Third Resistance | 95,326 |

| Fourth Resistance | 95,692 |

Detailed Bullish Scenario Explanation

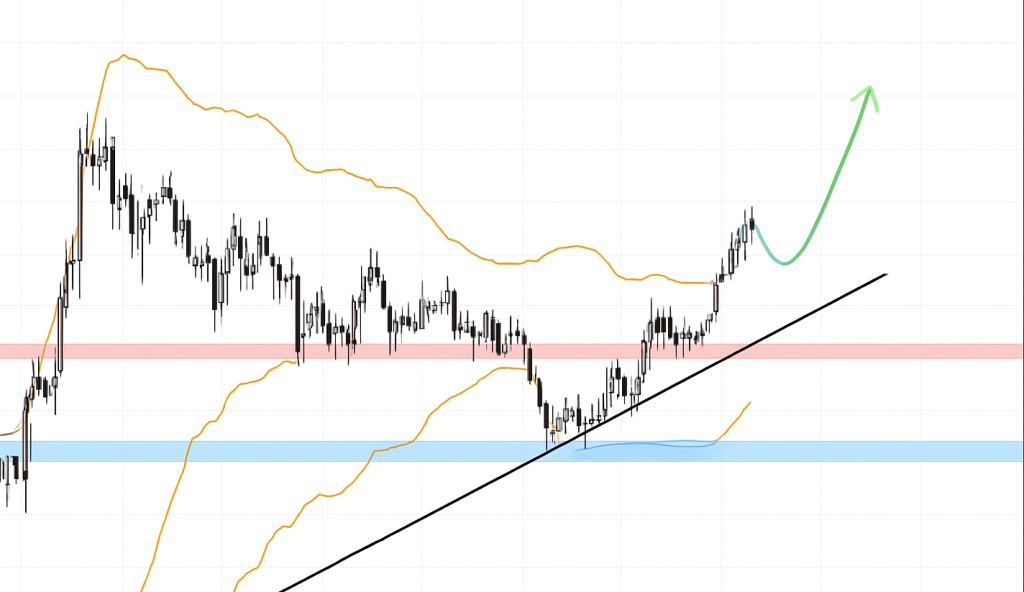

The bullish scenario depends on Bitcoin maintaining support levels while continuously breaking through resistances, paving the way for new highs.

| Bullish Scenario Conditions | Details |

|---|---|

| Hold Above 93,891 | Confirmed |

| Break Through 94,956 | Likely |

| Targeting 96,000 | Very Likely |

Detailed Bearish Scenario Explanation

The bearish scenario assumes failure to hold key supports, leading to a possible deeper correction.

| Bearish Scenario Conditions | Details |

|---|---|

| Break Below 93,891 | Warning |

| Break Below 93,175 | Strong Negative |

| Target Towards 91,000 | Possible |

Major Economic News Today and Their Impact on Bitcoin

Economic news plays a crucial role in influencing Bitcoin’s behavior, especially regarding risk sentiment, monetary policies, and liquidity movements.

| Event | Time (GMT) | Expected Impact |

|---|---|---|

| Goods Trade Balance | 15:30 | Medium Impact |

| Preliminary Wholesale Inventories | 15:30 | Low Impact |

| S&P/Case-Shiller Home Price Index | 16:00 | Strong Impact |

| ISM Manufacturing PMI | 16:00 | Strong Impact |

| JOLTS Job Openings | 16:00 | Medium Impact |

Economic Impact Analysis: Today’s economic data, especially regarding US trade and manufacturing sectors, could significantly influence risk appetite. A weaker USD resulting from disappointing figures might encourage more capital inflows into Bitcoin as a safe-haven asset.

Movement Prediction :

Frequently Asked Questions (FAQ)

- What is BTCUSD trend today? The trend is strongly bullish with supportive technical indicators.

- What are the key BTCUSD support levels now? Primary support lies around $93,891.

- When could BTCUSD begin a bearish correction? A break below $93,891 could trigger a deeper pullback.

- Do RSI and MACD indicators support further upside? Yes, both indicators are aligned with continued bullish momentum.

- How do economic news releases impact Bitcoin? Negative US economic data often boosts BTCUSD as investors seek alternative assets.

Expert Bitcoin Trading Tips

- Closely monitor breakouts above resistance levels.

- Always place a stop-loss below $93,891 to protect from sudden reversals.

- Avoid heavy new positions just before major economic data releases.

Capital Management Advice for Trading Bitcoin

Given BTCUSD high volatility nature:

- Never risk more than 2% of your capital per trade.

- Always use both stop-loss and take-profit levels.

- Scale entries instead of committing to full positions at once.

Update Date: April 28, 2025

Analysis Time: After New York session close and before the Asian session open.