1. Introduction to the NENSTAR Harmonic Pattern

The NENSTAR is a powerful harmonic pattern offering:

✔ High-accuracy reversals (80%+ success rate)

✔ Clear Fibonacci measurements

✔ Exceptional risk-reward ratios (1:5+)

✔ Effective across Forex, stocks, and crypto

Key Characteristics:

- Appears at market extremes (tops/bottoms)

- Combines ABCD and Gartley elements

- Requires precise Fibonacci alignments

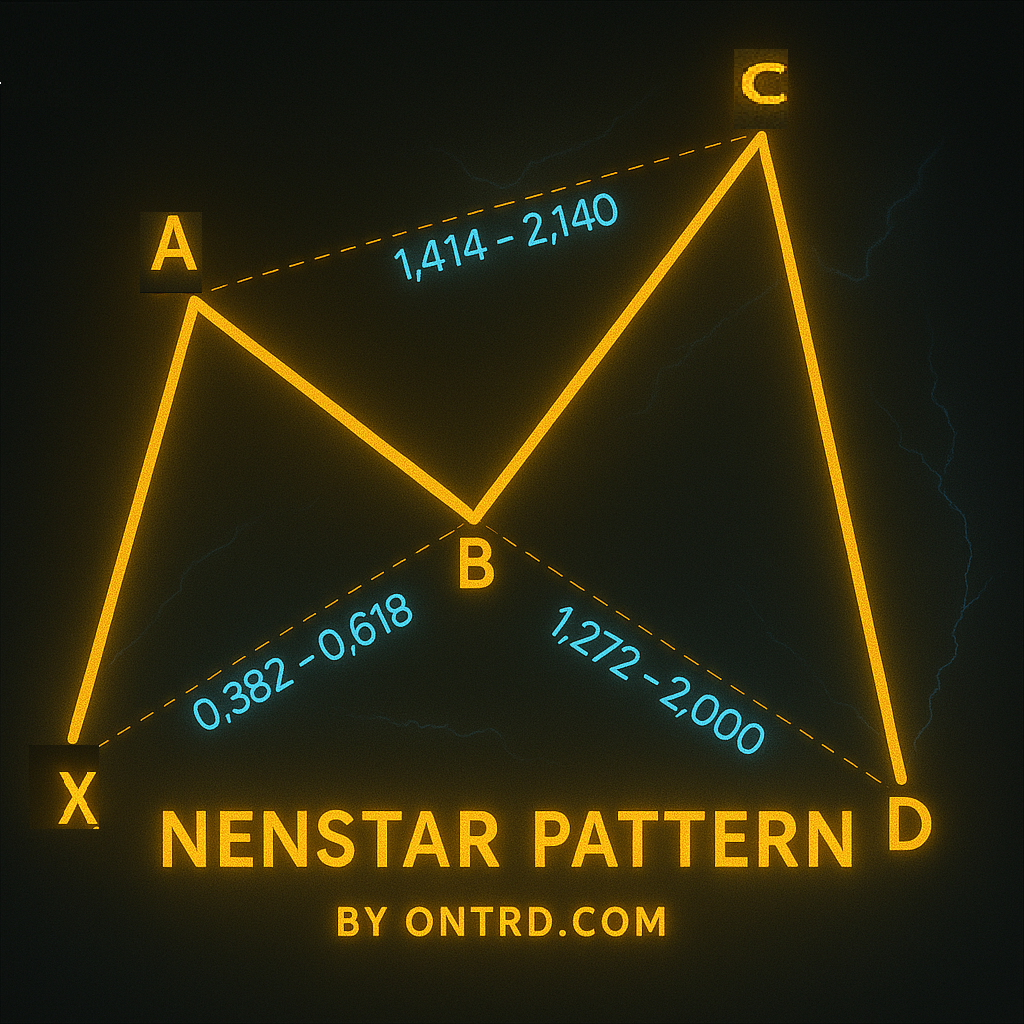

2. NENSTAR Harmonic Pattern Structure & Fibonacci Ratios

5-point structure (X-A-B-C-D) with strict Fibonacci rules:

| Wave | Bullish NENSTAR | Bearish NENSTAR |

|---|---|---|

| AB | 38.2%-78.6% of XA | 38.2%-78.6% of XA |

| BC | 113%-141.4% of AB | 113%-141.4% of AB |

| CD | 1.27%-2.618% of BC | 1.27%-2.618% of BC |

| XD | 1.13-1.272of XA | 1.13-1.272of XA |

3. Step-by-Step Identification

Bullish NENSTAR Harmonic Pattern Setup

- XA: Strong downward impulse

- AB: 38.2%-78.6% retracement

- BC: 113%-141.4% extension (counter-trend)

- CD: 1.27%-2.618% retracement of BC

- D Point: At 1.13-1.272XA extension

Bearish NENSTAR Harmonic Pattern Setup

- XA: StrongUupword impulse

- AB: 38.2%-78.6% retracement

- BC: 113%-141.4% extension (counter-trend)

- CD: 1.27%-2.618% retracement of BC

- D Point: At 1.13-1.272XA extension

(Alt text: NENSTAR harmonic pattern structure with Fibonacci levels)

(Alt text: NENSTAR harmonic pattern structure with Fibonacci levels)

4. Trading Strategy & Execution

Entry Triggers

- Bullish NENSTAR: Buy at D point with:

- Bullish pin bar or engulfing candle

- RSI > 30 and rising

- Bearish NENSTAR: Sell at D point with:

- Bearish pin bar or engulfing candle

- RSI < 70 and falling

Stop Loss Rules

| Pattern Type | SL Placement |

|---|---|

| Bullish | 1.5x ATR below D |

| Bearish | 1.5x ATR above D |

Take Profit Targets

| Target | Fibonacci Level |

|---|---|

| TP1 | 38.2% retracement of AD |

| TP2 | 61.8% retracement of AD |

| TP3 | 100% projection of XA |

5. Confirmation Techniques

✔ Price Action Signals:

- Bullish: Hammer + volume surge

- Bearish: Shooting Star + volume surge

✔ Indicator Confluence:

- RSI divergence (mandatory)

- MACD crossover at D point

✔ Timeframe Synergy:

- Must align with higher timeframe S/R levels

6. NENSTAR vs. Other Harmonic Patterns

| Feature | NENSTAR Pattern | Bat Pattern |

|---|---|---|

| Accuracy | 80%+ | 75% |

| Frequency | Moderate | Common |

| Risk/Reward | 1:5+ | 1:3 |

| Key Ratio | 1.27-1.414 XA | 0.886 XA |

7. Expert Trading Tips

- Pattern Rarity: Appears 5-10 times/year per major currency pair

- Multi-Timeframe Analysis: Confirm on H4 + Daily charts

- News Avoidance: Don’t trade during FOMC/NFP events

- Backtesting: Analyze historical reversals at 1.27-1.414 extensions

- Position Sizing: Never risk >1.5% per trade

8. Frequently Asked Questions (FAQ)

Q1: Why “NENSTAR” name?

A: Combines “NEN” (Japanese for price) and “STAR” (reversal star pattern).

Q2: Best markets for NENSTAR?

A: Most profitable in EUR/USD, GBP/JPY, and BTC/USD.

Q3: How to avoid false signals?

A: Requires:

- Exact Fibonacci ratios

- Volume confirmation

- Minimum 3-candle formation at D point

Q4: Optimal timeframes?

A: Best results on 4H and Daily charts.

9. Conclusion & Action Plan

The NENSTAR pattern delivers:

✅ High-probability reversals

✅ Precision Fibonacci entries

✅ Outstanding reward potential

Your Execution Plan:

- Backtest 50+ historical examples

- Mark key 1.27-1.414 extensions on charts

- Simulate trades with price alerts

- Deploy live with 0.5% risk per trade

- Be ware Of Economic News .

🚀 Pro Tip: Combine with Ichimoku cloud for trend confirmation.

Best Indicator to detect Harmonic Patterns is : ON Trade Waves Patterns

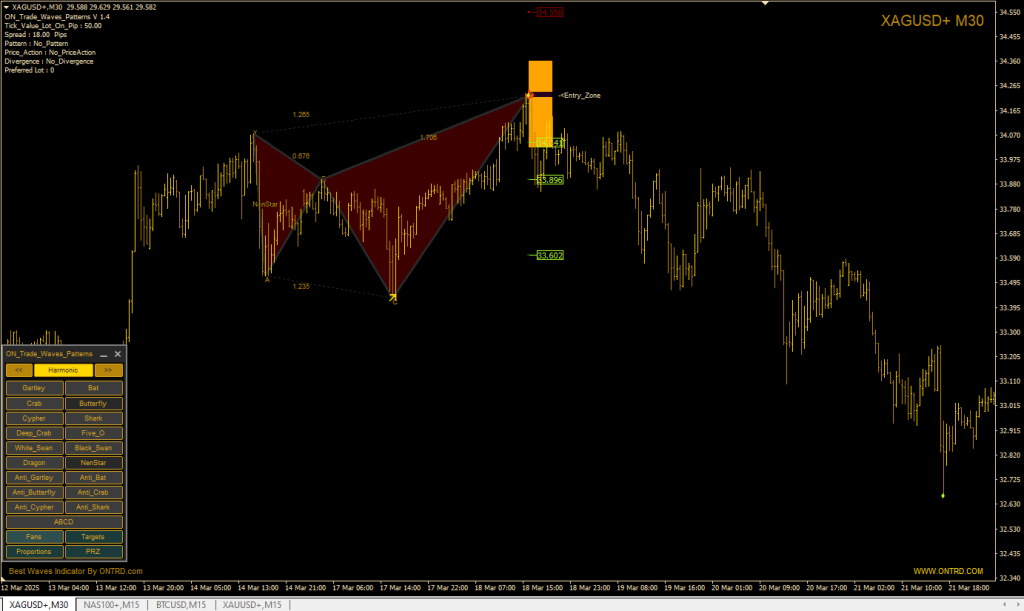

Example :