Did Trump’s tariffs kill economic populism?

Lasting damage has been done not only to Trump’s political credibility but to globalisation as a system

At the beginning of this helter-skelter week, Downing Street was declaring globalisation not only dead but a failure. Now, only five trading days later, the autopsy is still under way but the victim may instead be economic populism, strangled by Wall Street, the citadel of globalisation. Donald Trump’s so-called liberation day may in fact have been the anti-globalist’s entombment day.

In an effort to deny even a tactical retreat, Trump’s aides insist the White House goal all along was not to weaken globalism, or even to protect the US economy with tariffs, but instead to get into a negotiation to lower tariffs around the world and to punish China. As cover stories go, it is hardly credible, partly because the tariffs were repeatedly lauded by Trump as a macroeconomic revenue-raising measure, or a means to bolster US manufacturing.

Franklin Templeton to list $1.7bn of Uzbekistan state assets

France and Germany avoid recession as economies return to growth; UK house prices drop – business live

Rolling coverage of the latest economic and financial news, including growth figures from across Europe

- UK house prices fall but market ‘likely to pick up’ during summer

- China manufacturing activity plummets amid Trump tariff war

France’s economy is likely to “flirt with stagnation” throughout the year, despite the small rebound in GDP in the last quarter, predicts Dutch bank ING.

Charlotte de Montpellier, ING’s senior economist for France and Switzerland, explains:

The additional customs duties in the US and their direct and indirect impact will delay the French economy’s rebound. We estimate that the direct effect of a permanent 10% import duty in the US on French GDP (via a reduction in exports) will be around -0.1%.

Adding to this are the effects of uncertainty, the global economic slowdown and more restrictive fiscal policy, all of which will weigh on French economic activity throughout the year. The cooling in the labour market is likely to limit the recovery in household consumption, and the savings rate is set to remain high.

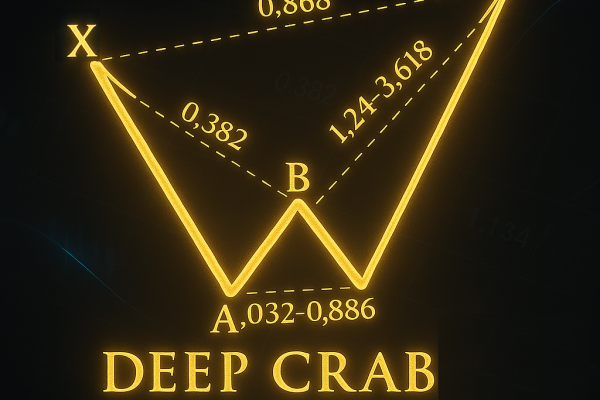

The Deep Crab Harmonic Pattern: Ultimate Trading Guide

Introduction to the Deep Crab Pattern The Deep Crab harmonic pattern is a powerful variation of the classic Crab pattern, first identified by Scott Carney. This advanced pattern is particularly valuable for spotting: ✔ Extreme price reversals in trending markets✔ High-probability trade setups with precise Fibonacci levels✔ Explosive moves following pattern completion✔ Reliable signals across…