EUR/USD Market Summary

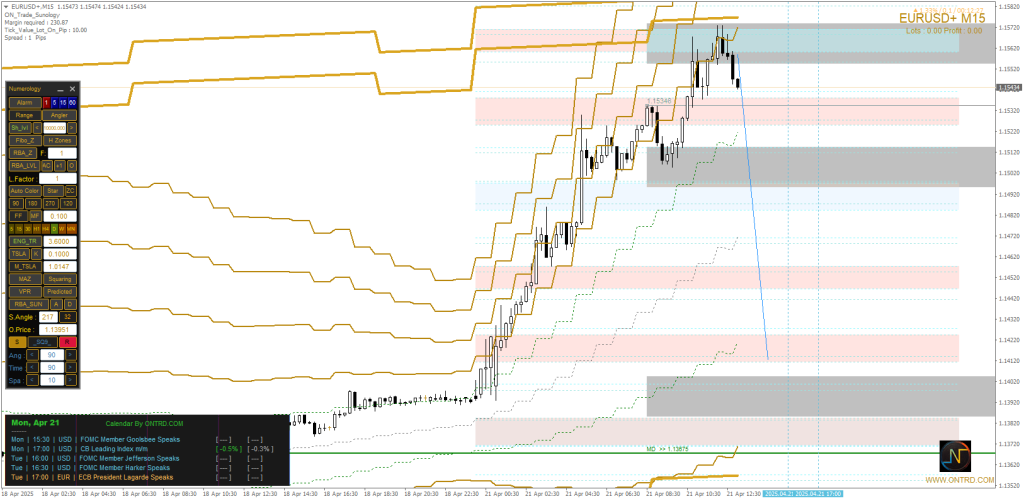

The EUR/USD pair continued its sharp rally from late last week, breaking through multiple resistance zones and reaching a peak near 1.1575 earlier today. After this aggressive bullish momentum, the pair has started showing signs of exhaustion near the upper range, facing rejection from a major supply zone. While the overall trend remains bullish, today’s price behavior suggests a possible short-term pullback or a temporary consolidation before the next directional move.

The 15-minute chart shows a clear upward impulse that is now pausing under a heavy resistance area. A break above today’s highs could spark fresh bullish continuation, while failure to hold current support levels may lead to a corrective retracement.

Technical View

The EUR/USD pair is currently trading around 1.1543, slightly lower than the intraday highs. The market printed a clean bullish leg from April 18, breaking above consolidation and forming consistent higher highs.

At the time of analysis, the pair is testing the first key support zone around 1.1530, which has been acting as the intraday pivot.

- Resistance area is seen between 1.1560 – 1.1575, which capped the recent rally.

- Support area sits between 1.1510 – 1.1490, and a deeper structure lies near 1.1460.

- The short-term trend is still bullish, but signs of weakening momentum are visible.

- A confirmed break below 1.1510 may trigger a deeper correction toward 1.1460.

Key Levels to Watch

| Level | Type | Comment |

|---|---|---|

| 1.1575 – 1.1560 | Resistance Zone | Key supply zone and previous session high |

| 1.1530 | Minor Support | Intraday structure; currently acting as price stabilizer |

| 1.1510 – 1.1490 | Main Support | Prior breakout zone; expected to act as strong demand area |

| 1.1460 | Lower Support | Final bullish defense level before shift in structure |

Scenario Forecasts

✅ Bullish Continuation Scenario:

- A bounce from the 1.1530 – 1.1510 support zone, with bullish price action confirmation, could trigger a move back toward 1.1560 and possibly break above 1.1575.

- In case of a clean breakout above 1.1575, expect extended targets at 1.1600 – 1.1625.

- This scenario remains valid as long as price holds above 1.1490.

❌ Bearish Correction Scenario:

- Failure to hold above 1.1510 could increase bearish pressure.

- A confirmed breakdown below 1.1490 may lead to deeper retracement targeting 1.1460, and even 1.1420 if momentum builds.

- Bearish divergence on the RSI and momentum oscillators supports this scenario.

➖ Neutral/Sideways Scenario:

- If price stays range-bound between 1.1530 – 1.1560, it would indicate market indecision.

- This could lead to consolidation until the next major news catalyst (such as FOMC or ECB commentary).

- Avoid aggressive entries inside this range unless price provides clear direction.

Economic Events – April 21, 2025

Today is expected to be eventful for both the USD and the EUR, with several high-impact central bank speeches scheduled:

| Time (GMT) | Currency | Event | Impact Level |

|---|---|---|---|

| 15:30 | USD | FOMC Member Goolsbee Speaks | High |

| 17:00 | USD | CB Leading Index m/m | Medium |

| 16:00 | USD | FOMC Member Jefferson Speaks | High |

| 16:30 | USD | FOMC Member Harker Speaks | High |

| 17:00 | EUR | ECB President Lagarde Speaks | Very High |

Potential Impact:

- Dovish comments from the ECB may weaken the euro, leading to bearish pressure.

- Hawkish tone from FOMC speakers may strengthen the USD and fuel a EUR/USD pullback.

- Traders should be cautious during these event hours as volatility may spike.

Conclusion EUR/USD

EUR/USD has been in a strong bullish trend, but price action near the 1.1575 resistance area hints at short-term exhaustion. The direction from here will likely depend on whether the pair can sustain above 1.1510 and whether the upcoming economic events provide bullish or bearish catalysts.

- The bias remains bullish above 1.1490, with targets at 1.1575 and 1.1600.

- A break below 1.1490 would shift momentum and trigger a short-term correction.

🔔 Trading Tip The EUR/USD

Wait for confirmation before jumping into any position. Use tight stops if trading during economic events.