Introduction:

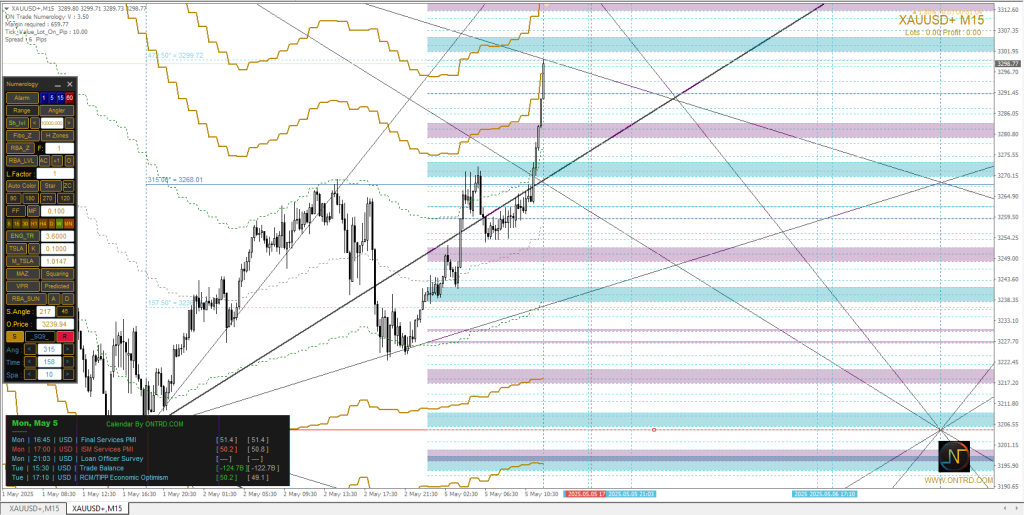

Gold Analysis continues its bullish momentum for the fourth consecutive day, extending its gains and stabilizing at $3285.74, reflecting active buying above key technical zones. With solid resistance levels overhead and firm support beneath, traders are treating this phase as an opportunity to rebalance positions and plan scenarios based on logical liquidity pockets above and below critical zones.

Current Price Action and Trend:

Gold is currently trading at $3285.74, having decisively broken above the previous consolidation zone around $3268.01. This breakout occurred alongside strong bullish volume and institutional participation as reflected in candlestick formation and volatility. The trend remains upward unless a break below the key dynamic support of $3239.94 occurs.

Technical Indicators on Gold Analysis:

RSI:

The Relative Strength Index stands near 66, suggesting sustained bullish momentum that hasn’t yet entered the overbought zone. A move above 70 would further validate institutional buying pressure.

MACD:

The MACD shows a strong bullish crossover with expanding histogram bars above the zero line, confirming ongoing positive momentum with no reversal signals at present.

Moving Averages:

Price action is positioned above both short- and medium-term moving averages (20 & 50), further reinforcing the bullish structure and providing dynamic support.

Key Support Levels:

| Level | Price |

|---|---|

| First Support | 3268.01 |

| Second Support | 3239.94 |

| Third Support | 3205.00 |

These levels act as pivot zones in case of a corrective pullback. The $3268 level is the nearest key buffer; its breach could open a path toward retesting the $3239 base.

Key Resistance Levels:

| Level | Price |

|---|---|

| First Resistance | 3299.72 |

| Second Resistance | 3331.58 |

| Third Resistance | 3360.00 |

These resistance zones present upside targets in the bullish scenario. A breakout above $3299.72 would trigger a move toward $3331.58, a medium-term technical barrier.

Bullish Scenario:

| Condition | Expected Outcome |

|---|---|

| Holding above $3285 | Momentum continuation to $3299.72 |

| Break and close above $3300 | Acceleration toward $3331.58 |

| RSI confirmation above 70 | Further institutional inflow |

As long as the price remains above $3268, the bullish outlook is favored, reinforced by the rising trendline.

Bearish Scenario:

| Condition | Expected Outcome |

|---|---|

| Break below $3268.01 | Pullback toward $3239.94 |

| Sustained drop under $3239 | Further fall to $3205 |

| Bearish MACD crossover | Mid-term selling pressure |

This scenario is less likely but remains valid if strong sell signals emerge, especially if supported by volume spikes.

Economic Events for Today:

| Time | Currency | Event | Forecast | Previous |

|---|---|---|---|---|

| 16:45 | USD | Final Services PMI | 51.4 | 51.4 |

| 17:00 | USD | ISM Services PMI | 50.2 | 50.8 |

| 21:00 | USD | Loan Officer Survey | – | – |

| 15:30 | USD | Trade Balance | -124.7B | -122.7B |

| 17:10 | USD | RCM Economic Optimism Index | 50.2 | 49.1 |

These reports directly influence the US Dollar and thereby impact gold prices. Weak data may boost gold, while stronger-than-expected figures could weigh it down.

Frequently Asked Questions (FAQ):

1. Is the bullish trend still valid? Yes, as long as gold holds above $3268.01.

2. What are the next upside targets? $3299.72 followed by $3331.58.

3. Is there risk of reversal? Only if $3239.94 is broken with heavy volume.

4. When is it safe to buy? A confirmed breakout above $3300 with volume and RSI confirmation.

5. What does resistance at $3331 mean? A key barrier that could either cap gains or trigger continuation.

Expert Trading Advice:

Watch for a firm daily close above $3300 to activate new long positions. Place stop losses just below $3268 to minimize downside risk. Scale into positions gradually, especially in volatile market sessions.

Capital Management Tips:

Risk per trade should not exceed 1.5% of your total capital. Use hard stop-loss levels and avoid overleveraging, especially with gold’s typical price swings.

you can also check pur products from this link to have your perfect way in analyzing :