The Dow Jones Industrial Average (DJIA) is at a critical inflection point today, caught between bullish economic data and hawkish Federal Reserve signals. As one of the world’s most-watched equity benchmarks, its movements reflect:

1️⃣ Macro Forces: Today’s surge in U.S. durable goods orders (+3.1% vs. -1% forecast) underscores resilient industrial demand.

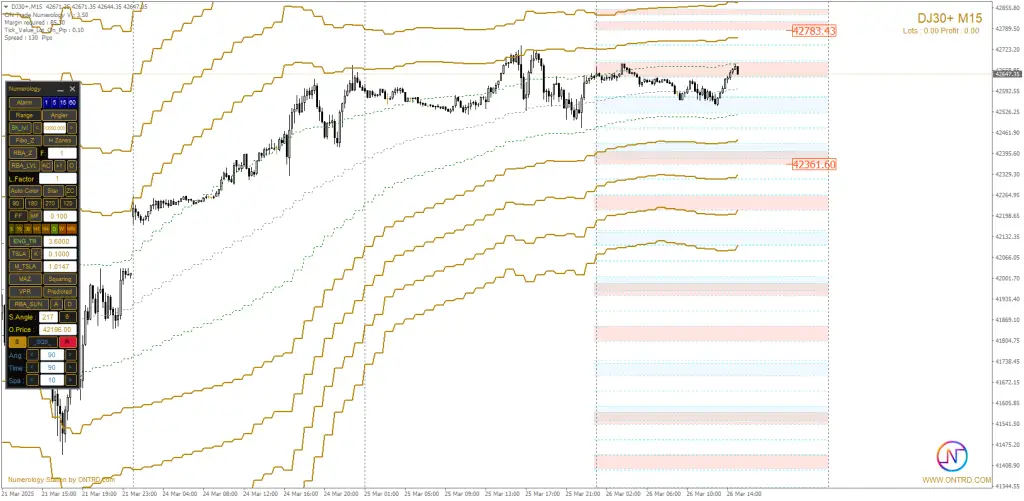

2️⃣ Technical Tensions: Price hovers near resistance at 42,768 (R1) while RSI flirts with overbought territory.

3️⃣ Liquidity Crosscurrents: Conflicting cues from Fed speakers and oil inventory builds add layers of complexity.

Support Levels For Dow Jones :

- S1: 42,356

- S2: 42,000

- S3: 41,566

Resistance Levels For Dow Jones :

- R1: 42,768

- R2: 43,000

- R3: 43,134

Key Observation:

“DJIA is currently testing R1 (42,768). A confirmed breakout could trigger a rally toward R2 (43,000), while rejection may push prices to S1 (42,356).”

📉 Today’s Economic Catalysts

| Event | Actual | Forecast | Impact on DJIA |

|---|---|---|---|

| U.S. Durable Goods (MoM) | +3.1% ▲ | -1.0% | Bullish (Strong demand) |

| Durable Goods ex-Transport | 0.0% | 0.2% | Neutral |

| EIA Crude Oil Stocks | +1.745M | +1.5M | Mild Bearish (Demand concerns) |

| Fed’s Kashkari Speech | Hawkish Tone | – | Bearish Pressure |

Immediate Market Reaction:

- DJIA initially rose +0.5% post-durable goods data but pared gains after Kashkari’s hawkish comments.

📊 Technical Indicators

- RSI (14): 64 (Approaching overbought)

- MACD: Bullish but flattening

- Price Action: Testing upper Bollinger Band (42,800)

- 50-Day MA: 41,500 (Strong support)

Key Trend Conflict:

“Strong fundamentals (durable goods) support upside, but technicals suggest short-term overextension. Watch for consolidation.”

🔴⚪🔵 Trading Scenarios

1) Bullish Breakout (30% Probability)

- Trigger: Close above 42,768 (R1)

- Targets: 43,000 → 43,134

- Confirmation Needed: Rising volume + dovish Fed comments

2) Bearish Rejection (50% Probability)

- Trigger: Failure at R1 + oil inventory buildup

- Targets: 42,356 (S1) → 42,000 (S2)

- Risk Factor: Hawkish Fed rhetoric

3) Sideways Consolidation (20% Probability)

- Range: 42,356 – 42,768

- Action: Range-bound strategies preferred

🎯 Strategic Takeaways

Fed Watch: Monitor Musalem’s speech (17:10 EST) for rate clues.

Intraday Traders: Sell rallies near 42,768 (R1) with tight stops above 42,800.

Swing Traders: Wait for clear breakout/breakdown with volume confirmation.

📢 Let us know your thoughts Contact US.