The BAT harmonic pattern is one of the most reliable price structures in harmonic trading. Developed by Scott Carney, it improves upon the classic Gartley pattern with stricter Fibonacci ratios, leading to higher-probability reversals.

In this guide, we’ll cover:

✅ Origins of the BAT Harmonic Pattern

✅ Key Fibonacci ratios

✅ How to identify & trade it

✅ Stop loss & take profit rules

✅ Confirmation signals

✅ FAQs & pro tips

1. Who Discovered the BAT Harmonic Pattern?

- Creator: Scott Carney (early 2000s)

- Purpose: Enhance the Gartley pattern with more precise Fibonacci levels

- Why the name? The pattern resembles a bat’s wings when drawn on a chart.

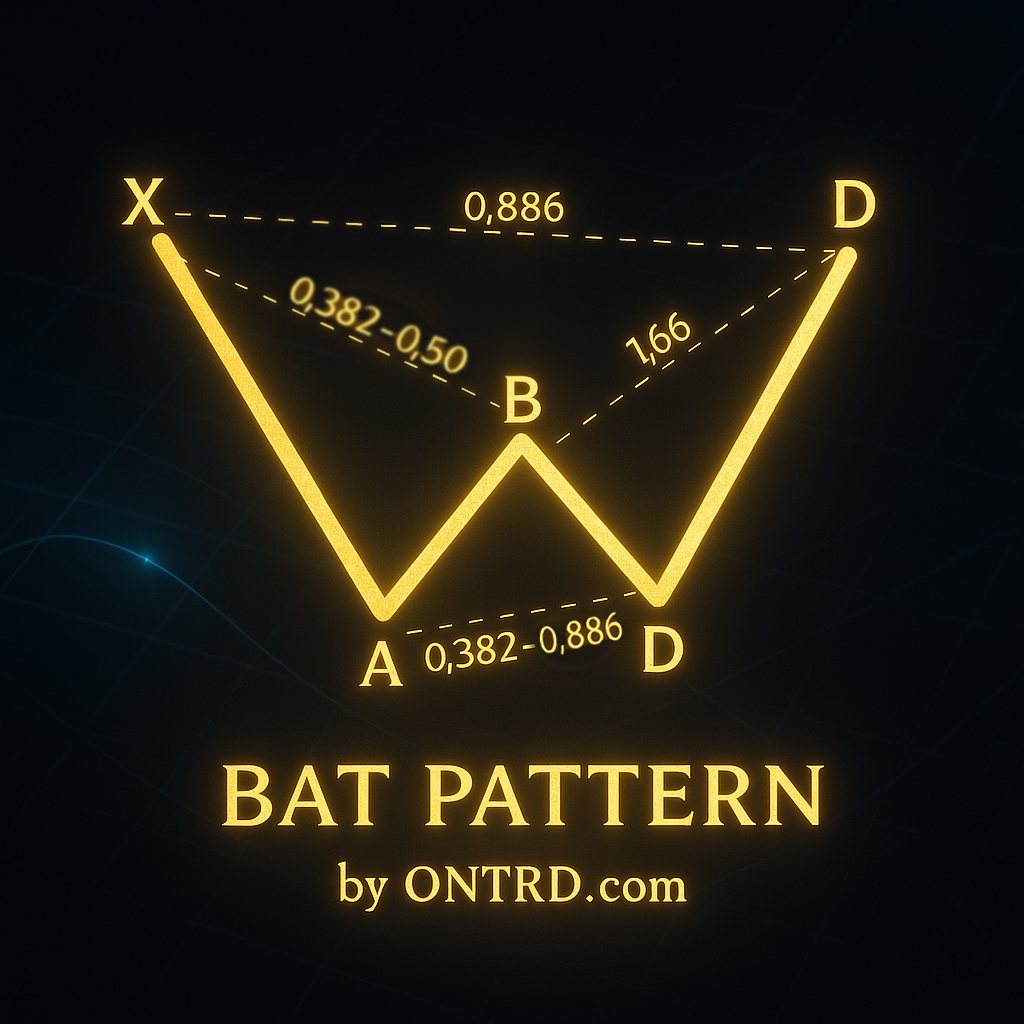

2. BAT Harmonic Pattern Structure & Fibonacci Ratios

The BAT pattern consists of 5 key points (X-A-B-C-D) with strict Fibonacci rules:

| Leg | Fibonacci Ratio |

|---|---|

| AB | 38.2% – 50% of XA |

| BC | 38.2% – 88.6% of AB |

| CD | 161.8% – 261.8% of BC (must reach 88.6% of XA) |

Bullish BAT vs. Bearish BAT

- Bullish BAT: Forms at a market bottom (buy at D)

- Bearish BAT: Forms at a market top (sell at D)

3. How to Trade the BAT Pattern (Step-by-Step)

Step 1: Identify the XA Leg

- Look for a strong impulsive move (up or down).

Step 2: Wait for AB Correction

- Must retrace 38.2% – 50% of XA.

Step 3: Confirm BC Leg

- Should retrace 38.2% – 88.6% of AB.

Step 4: Spot the CD Leg (Most Critical!)

- Must extend 161.8% – 261.8% of BC and reach 88.6% retracement of XA.

Step 5: Enter at Point D

- Buy (Bullish BAT) or Sell (Bearish BAT) with confirmation.

4. Stop Loss & Take Profit Rules

Stop Loss Placement

- Bullish BAT: Below point D

- Bearish BAT: Above point D

Take Profit Targets

| Target | Fibonacci Level |

|---|---|

| TP1 | 38.2% of AD |

| TP2 | 61.8% of AD |

| TP3 | 100% of AD (XA point) |

5. Confirmation Signals (Increase Accuracy)

To avoid false signals, use:

✔ Candlestick Patterns (Pinbar, Engulfing at D)

✔ RSI/MACD Divergence (Overbought/Oversold)

✔ Support/Resistance Alignment

✔ Volume Spike at Reversal

6. BAT Pattern vs. Gartley Pattern

| Feature | BAT Pattern | Gartley Pattern |

|---|---|---|

| CD Leg | 88.6% XA | 78.6% XA |

| Accuracy | Higher | Moderate |

| Complexity | More strict ratios | More flexible |

7. Frequently Asked Questions (FAQs)

Q1: Does the BAT pattern work in crypto?

A: Yes! It works in Forex, stocks, and crypto (BTC, ETH, etc.).

Q2: What’s the success rate of the BAT pattern?

A: Around 70-80% when confirmed with additional indicators.

Q3: How to avoid fake BAT patterns?

A: Always wait for price action confirmation (e.g., reversal candles at D).

Q4: Can I trade BAT on lower timeframes?

A: Yes (1H, 4H), but higher timeframes (Daily, Weekly) are more reliable.

8. Conclusion & Pro Tips

The BAT harmonic pattern is a powerful tool for spotting reversals with high precision. Key takeaways:

🔹 Strict Fibonacci ratios (88.6% XA is critical)

🔹 Always use confirmation signals

🔹 Manage risk with proper stop loss

🔹 Combine with trend analysis for best results

- Try to care about Economic News With Harmonic

If you’re searching for a reliable harmonic pattern, the BAT pattern offers one of the best risk-reward ratios in trading. Practice on a demo account first!

🚀 Ready to trade the BAT pattern like a pro? Try Our Indicator

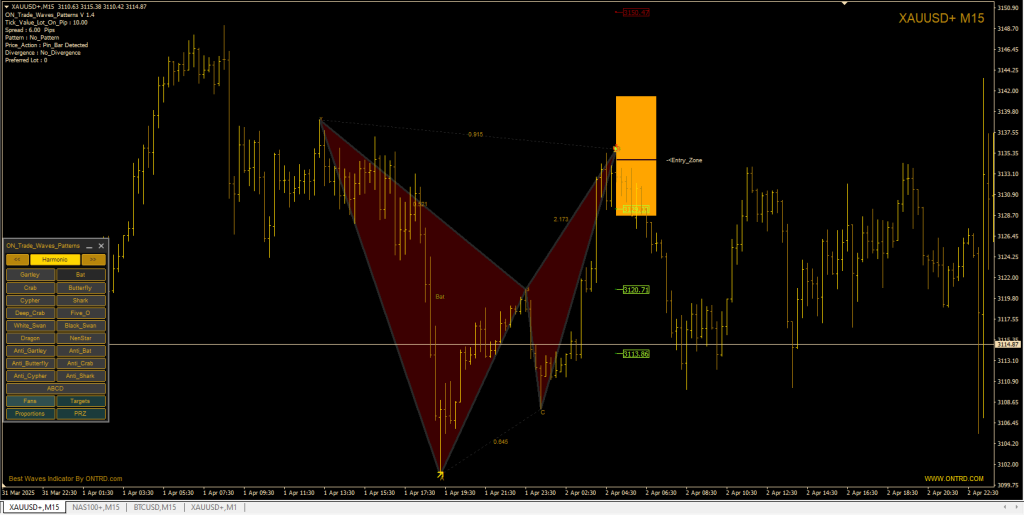

Example :