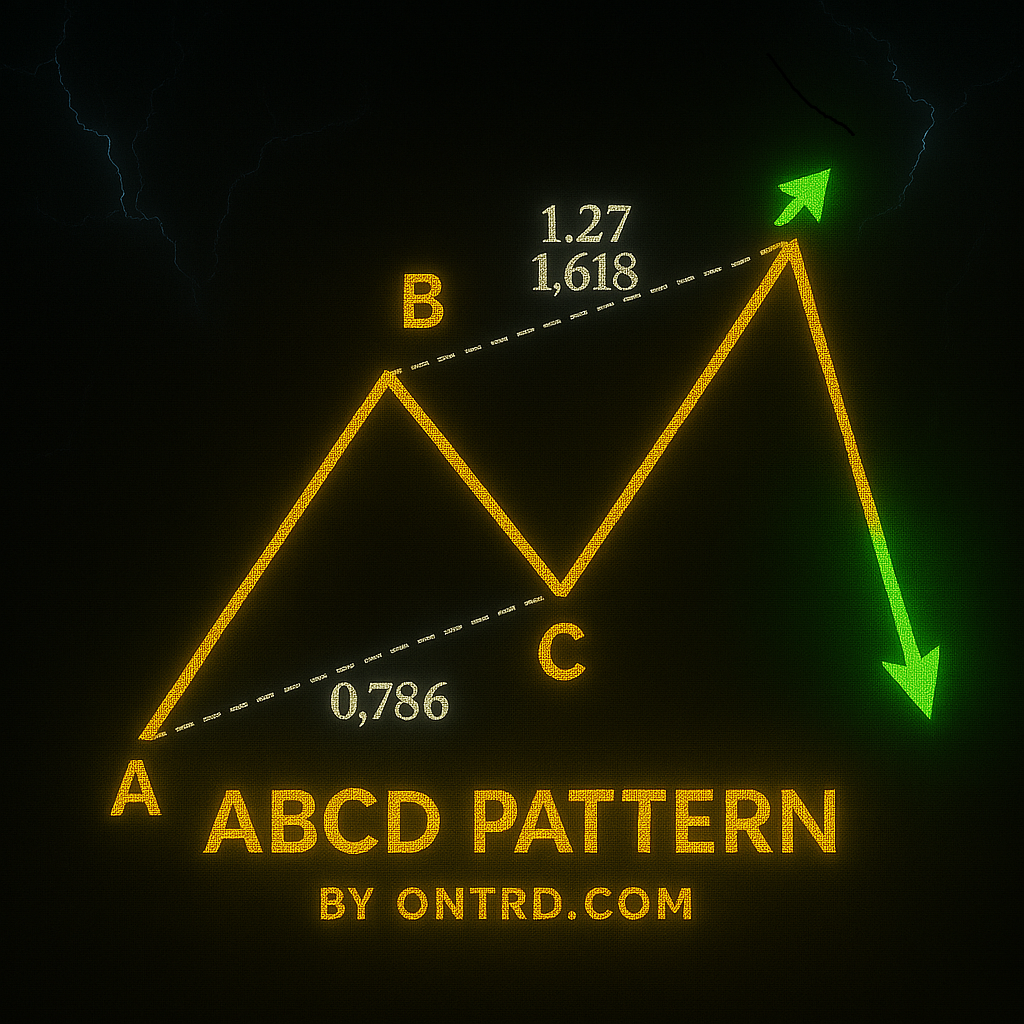

1. Introduction to the ABCD Pattern

The ABCD Harmonic Pattern is the most fundamental and widely-used harmonic pattern that forms the basis for all other harmonic patterns. This classic pattern offers:

✔ Simple yet powerful structure (only 4 points needed)

✔ High-probability reversal signals

✔ Clear Fibonacci rules for precise trading

✔ Works across all markets and timeframes

Key Benefit: The ABCD pattern helps traders identify potential trend reversals with mathematical precision.

2. Pattern Structure & Fibonacci Ratios

The ABCD consists of 4 key points (A-B-C-D) with these Fibonacci relationships:

| Wave | Fibonacci Requirement | Description |

|---|---|---|

| AB | Initial impulse move | – |

| BC | 38.2%-88.6% of AB | Retracement |

| CD | 127%-161.8% of BC | Must equal AB in length |

Bullish vs. Bearish ABCD

- Bullish ABCD: Forms at bottoms (Buy at D)

- Bearish ABCD: Forms at tops (Sell at D)

3. How to Identify the ABCD Pattern (Step-by-Step)

- Spot AB Wave: Strong price movement (up or down)

- Measure BC Retracement: Must be 38.2%-88.6% of AB

- Confirm CD Extension: Should be 127%-161.8% of BC

- Validate Symmetry: CD ≈ AB in price length

- Wait for Completion: Pattern completes at point D

Visual Tip: The pattern forms a perfect “lightning bolt” shape when correctly identified.

4. Trading the ABCD Pattern

Entry Strategy

- Buy (Bullish): At point D with bullish confirmation candle

- Sell (Bearish): At point D with bearish confirmation candle

Stop Loss Placement

| Pattern | Stop Position |

|---|---|

| Bullish ABCD | Below point D |

| Bearish ABCD | Above point D |

Take Profit Targets

| Target | Description |

|---|---|

| TP1 | 38.2% retracement of AD |

| TP2 | 61.8% retracement of AD |

| TP3 | 100% retracement (point A) |

5. Confirmation Signals for Higher Accuracy

✔ Price Action:

- Bullish: Hammer or engulfing pattern at D

- Bearish: Shooting star or dark cloud cover at D

✔ Technical Indicators:

- RSI divergence (most reliable)

- MACD crossover

- Volume spike at point D

✔ Timeframe Confluence:

- Aligns with higher timeframe support/resistance

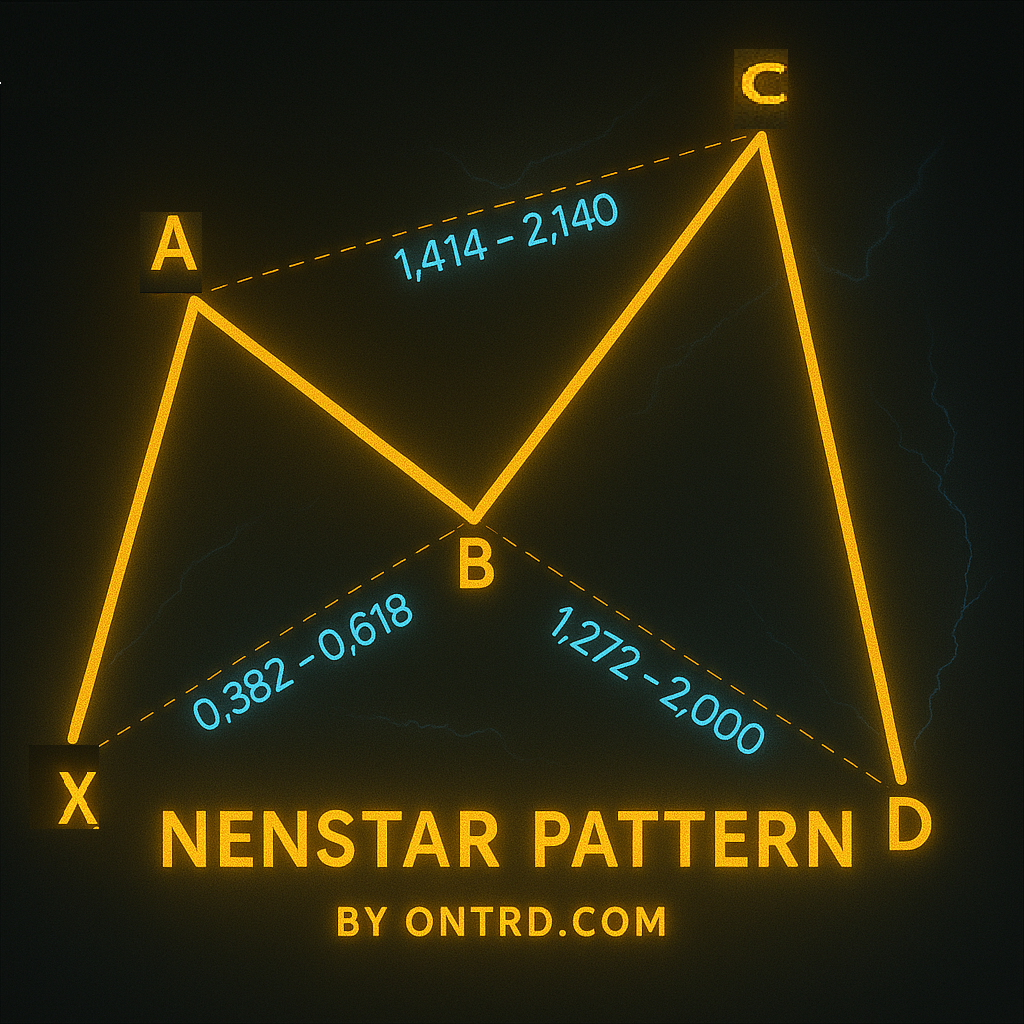

6. ABCD vs. Other Harmonic Patterns

| Feature | ABCD Pattern | Gartley Pattern |

|---|---|---|

| Complexity | Simple (4 points) | Complex (5 points) |

| Accuracy | 75%+ | 80%+ |

| Frequency | Very common | Moderate |

| Best For | Beginners | Advanced traders |

7. Professional Trading Tips

- Measure Twice, Trade Once: Always verify Fibonacci ratios

- Start Higher Timeframes: Daily charts offer most reliable signals

- Combine With Trends: Trade ABCD in direction of larger trend

- Risk Management: Never risk >2% per trade

- Practice First: Backtest on historical data before live trading

8. Frequently Asked Questions (FAQ)

Q1: Is the ABCD pattern reliable?

A: Yes, with proper confirmation it has 75%+ accuracy rate.

Q2: Best markets for ABCD patterns?

A: Works well in all liquid markets – especially EUR/USD, Gold, and Bitcoin.

Q3: How to filter false ABCD signals?

A: Require:

- Precise Fibonacci ratios

- Confirmation candle

- Supporting volume

Q4: Best timeframe for ABCD patterns?

A: 1-hour charts or higher for most reliable signals.

9. Conclusion & Action Plan

The ABCD pattern offers traders:

✅ Simple yet effective structure

✅ Clear entry/exit rules

✅ Strong risk-reward potential

Your Action Plan:

- Study 20+ historical examples

- Practice identifying on demo account

- Develop your confirmation checklist

- Start trading with small position sizes

- Beware of Economic News.

Final Thoughts: Mastering the ABCD Pattern for Consistent Profits

The ABCD harmonic pattern remains one of the most reliable and straightforward trading strategies, perfect for both beginners and experienced traders. By following its clear Fibonacci-based structure—AB impulse, BC retracement, and CD extension—you can identify high-probability reversal zones with precision.

Why the ABCD Pattern Works

- Mathematical Precision – The pattern relies on Fibonacci ratios (38.2%, 61.8%, 127%, 161.8%), which are deeply rooted in market psychology.

- Repeatable Structure – Unlike subjective chart patterns, the ABCD follows strict rules, reducing emotional trading.

- Versatility – It works across Forex, stocks, crypto, and all timeframes (though higher timeframes offer better accuracy).

Keys to Success

- Always wait for confirmation (bullish/bearish candle + RSI/MACD signals).

- Trade with the trend—ABCD reversals are stronger when aligned with the larger market direction.

- Risk management is crucial—never risk more than 1-2% per trade.

Final Tip

The best traders don’t just follow patterns—they understand why they work. Backtest the ABCD pattern on historical charts, refine your entry rules, and practice patience. Over time, you’ll develop the discipline needed to profit consistently.

Now it’s your turn—apply this strategy, stay disciplined, and watch your trading improve! 🚀

🚀 Pro Tip: Combine ABCD patterns with moving averages for trend confirmation.

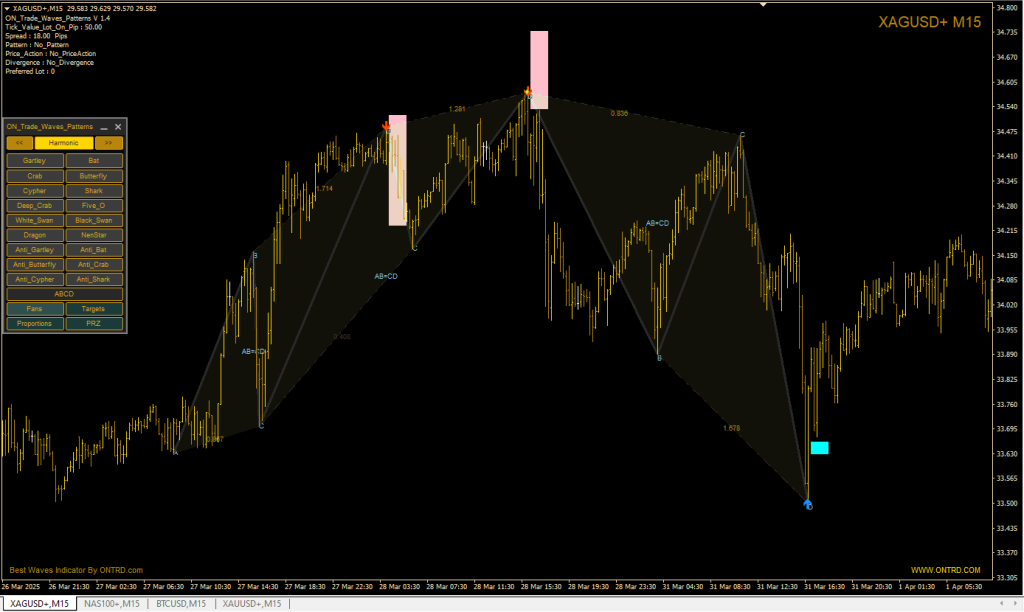

Best Indicator To Detect ABCD Pattern : ON Trade Waves Patterns