1. Introduction to Proactive Harmonic Trading

Proactive harmonic trading involves entering harmonic patterns before their final (D) point completes, allowing traders to:

✔ Capture better risk-reward ratios

✔ Avoid crowded entry levels

✔ Anticipate institutional movements

✔ Trade with tighter stop losses

Key Benefit: Positions taken at 50-75% pattern development often yield 2-3x better R:R than waiting for full confirmation.

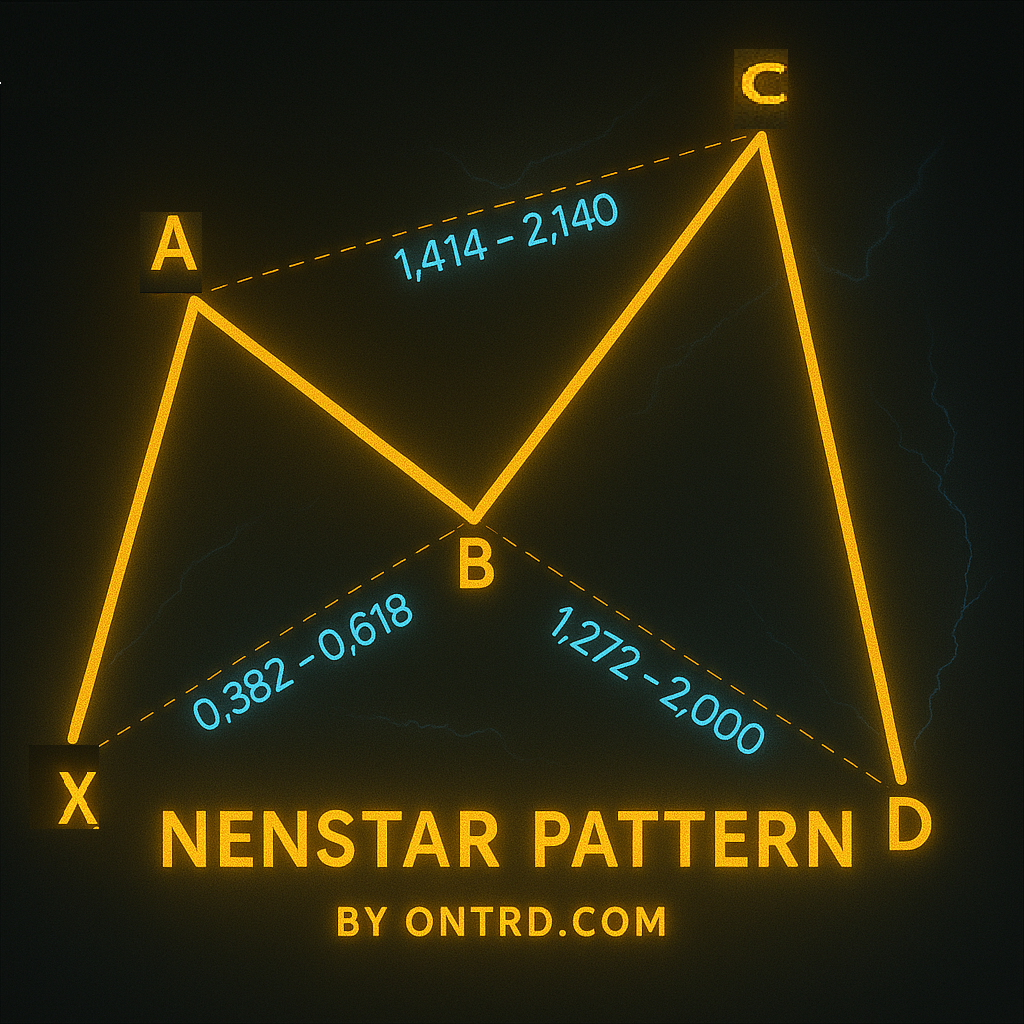

2. Best Patterns for Proactive Trading

| Pattern | Proactive Entry Point | Confirmation Method |

|---|---|---|

| ABCD | At 61.8% of BC leg | RSI divergence + pin bar |

| Gartley | When BC reaches 0.618 AB | MACD histogram reversal |

| Bat | At 88.6% retrace of XA | Volume spike rejection |

| Butterfly | When CD hits 1.272 BC | Order flow imbalance |

| Crab | At 1.618 XA extension | Liquidity pool break |

3. Step-by-Step Proactive Entry Strategy

Phase 1: Early Pattern Identification

- Mark initial XA leg

- Wait for AB retrace (38.2-61.8%)

- Plot Fibonacci extensions on BC leg

Phase 2: Pre-D Point Entry Triggers

For bullish patterns:

✅ Enter long when:

- Price reaches 61.8-78.6% of projected D zone

- Bullish engulfing forms

- RSI shows positive divergence

For bearish patterns:

✅ Enter short when:

- Price tests 127-161.8% extension area

- Bearish pin bar appears

- Volume exceeds 20-period average

Phase 3: Dynamic Position Management

- Initial Stop Loss: 1.5x recent swing high/low

- Take Profit 1: Equal to risk taken

- Take Profit 2: Full pattern projection target

4. Confirmation Techniques for Early Entries

Price Action Filters

✔ 3-Candle Rule: Require 3 consecutive confirming candles

✔ Wick Rejection: >50% wicks at key Fib levels

✔ Session Timing: London/NY overlap period entries

Indicator Confluence

- RSI: Must show divergence at entry zone

- MACD: Histogram crossing zero line

- Volume Profile: POC alignment with Fib level

Market Context

➤ Works best:

- After strong impulsive moves

- At major S/R levels

- During low liquidity periods (avoid news)

5. Risk Management for Proactive Trading

| Scenario | Action |

|---|---|

| Pattern fails | Exit at 1ATR beyond entry |

| Early TP1 hit | Trail stop to breakeven |

| No confirmation | Cancel pending orders |

Critical Rule: Never risk >1% capital on unconfirmed patterns.

6. Proactive vs Traditional Harmonic Trading

| Factor | Proactive Approach | Classic Approach |

|---|---|---|

| Entry Timing | 50-75% pattern completion | 100% completion at D point |

| Risk | 0.5-1ATR stop | 2-3ATR stop |

| Reward | 1:5-1:8 R:R potential | 1:3 typical |

| Accuracy | 60-70% (requires skill) | 75-80% |

7. Professional Tips for Success

- Pattern Selection: Focus on ABCD and Gartley – most reliable for early entries

- Timeframe Synergy: Confirm on Higher timeframe (e.g., H1 entry with D1 trend)

- Liquidity Check: Verify order book depth at entry zones

- Journaling: Track win rate variations between early/late entries

- Algorithm Assist: Use harmonic scanners for pattern probability scores

8. FAQ: Proactive Harmonic Trading

Q1: How early is too early to enter?

A: Never enter before BC leg establishes (minimum 38.2% retracement).

Q2: Best markets for proactive entries?

A: EUR/USD (London session), BTC/USD (low volatility periods).

Q3: Handling false breakouts?

A: Combine with liquidity indicators – false moves often show thin order book depth.

Q4: Optimal timeframes?

A: 15M for entries, 4H/Daily for context (scalping requires ultra-precise execution).

9. Conclusion & Action Plan

Proactive harmonic trading unlocks:

✅ Earlier entries with better prices

✅ Reduced competition at entries

✅ Superior risk management

Your Implementation Roadmap:

- Backtest 50+ early entries on historical data

- Start with demo trading using 61.8% BC entries

- Gradually incorporate liquidity analysis

- Scale live positions only after 70%+ demo accuracy

- Beware of Economic News.

🚀 Next-Level Tip: Use Volume-Weighted Fib Levels for institutional-grade entries.

Best Product To Draw Proactive Harmonic Patterns Manually Is : ON Trade Waves Patterns.