📖 Introduction

At the heart of Gann theory lies a mysterious yet powerful concept: the Square of Nine . This geometric grid is more than just a shape—it’s a mathematical model of how price and time move together. In this article, we break down how the Nine Square works and reveal the mathematical formula—the square root equation—used to calculate potential market tops and bottoms.

🔢 What is the Square of Nine ?

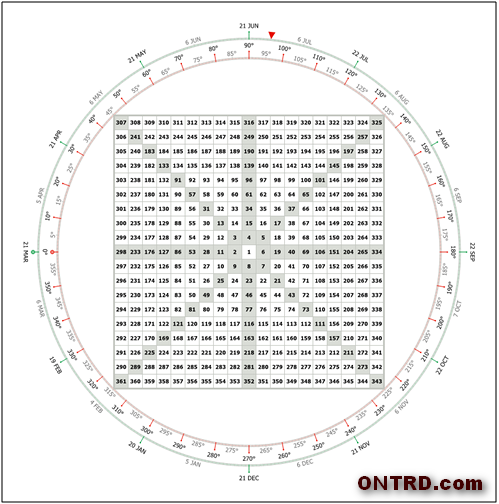

The Gann Square of Nine is a spiral or pyramidal representation of numbers arranged in cycles. It starts with the number 1 and moves outward clockwise or counterclockwise, forming full cycles:

What’s the point of this?

The utility of this talk is that the numbers took a whole cycle from the number 1 to the number9, which rolled in a whole 360 degrees.

We note that is clarification in the next increase up to the number 25, which is along the lines of the number 9, so this is reflected on prices.

Its reflection is that the price and time are only numbers on the nine square, so that the bottom or top is the center of the cycle (the beginning of the cycle).

The target of the full cycle is the number after 360 degrees on the square.

These cycles are the building blocks of Gann’s price-time symmetry. They suggest that market movements follow predictable, natural rhythms—not randomness.

It means , for example, if the number 9 is the value of the bottom, and the price starts to climb, then our target is the number 25(end point of full cycle 360°). Of course, this talk will come under rules and controls that we will talk about later in this course.

📐 Applying the Square of Nine in Trading

Let’s say price hits a low at 9. The next full cycle (360°) will complete at 25. The theory is that price moves in structured angular patterns that mirror these numerical rotations. Traders can anticipate future resistance or support levels by understanding where the market sits on the square.

The key takeaway? Price is not random—it respects angular geometry.

🧮 Introducing the Square Root Formula

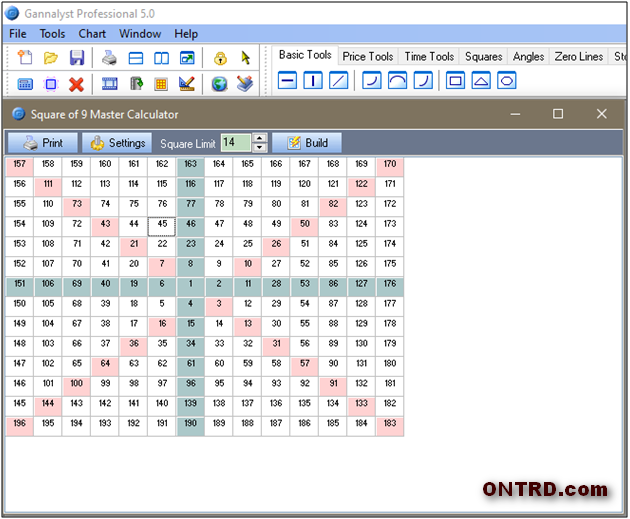

Because it’s impractical to constantly consult a physical square, Gann practitioners developed a mathematical shortcut: the square root formula. Here’s how it works:

Formula Steps:

- Take the price (e.g., a bottom or top), round it to the nearest whole number.

- Calculate the square root of that price.

- Add the angle factor:

- For 90°, use 0.5

- For 180°, use 1

- For 360°, use 2

- Square the result to find your target price.

- Reattach the original decimals if needed.

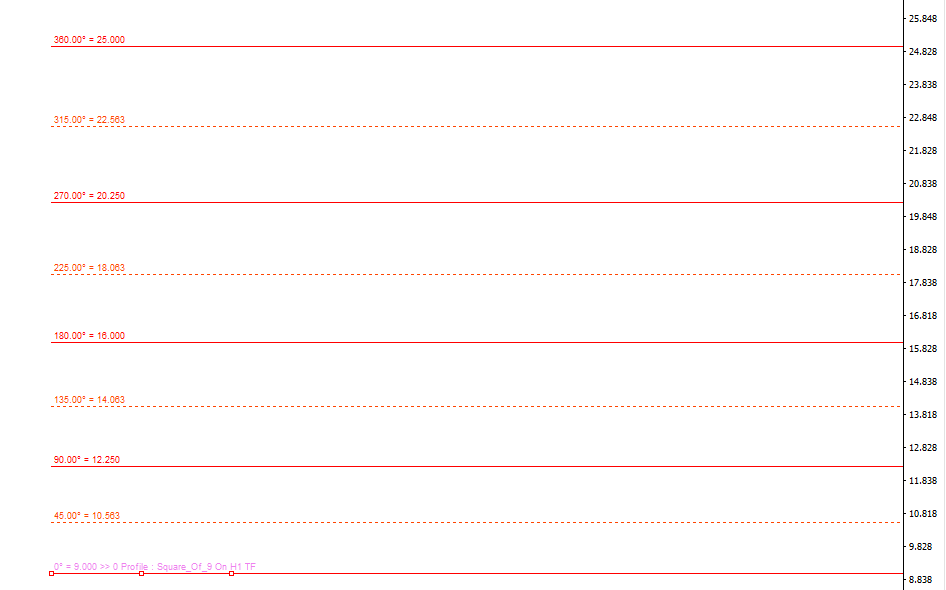

This formula gives you a projected price level aligned with a geometric angle.

🔄 Angle Factors and Their Meaning

The factor you add in step 3 is what determines the angle of the market’s rotation:

- 0.5 → 90° (Quarter cycle)

- 1.0 → 180° (Half cycle)

- 2.0 → 360° (Full cycle)

This allows traders to forecast whether the market is heading toward a short-term correction or a major reversal.

🔍 Why This Equation Matters

The genius of this formula lies in its simplicity and power. With it, you can:

- Predict price targets based on past highs or lows

- Identify areas of strong confluence

- Enhance your entries and exits by anticipating market symmetry

And when combined with indicators like the ON Trade Gann Squares, this becomes even more precise—drawing the lines automatically based on the square root rule.

🔁 Real Market Example

If a bottom is at price 9:

- √9 = 3

- Add 2 (for 360° cycle): 3 + 2 = 5

- Square it: 5² = 25

So, the target price is 25. If that aligns with other indicators or resistance levels, it becomes a high-probability exit or reversal zone.

🔚 Conclusion

The Nine Square is not just theory—it’s a practical system. By using the square of nine root formula, traders gain access to a level of price forecasting that aligns with natural market geometry. Whether you’re trading Forex, stocks, or commodities, this method allows you to “see the future” by understanding the math behind market motion.

The Best Product that can draw Square of 9 on Chart is ON Trade Gann Squares there is version for MT4 and MT5.