Price range: 80 $ through 150 $

Description

ON Trade Currency Strength Indicator

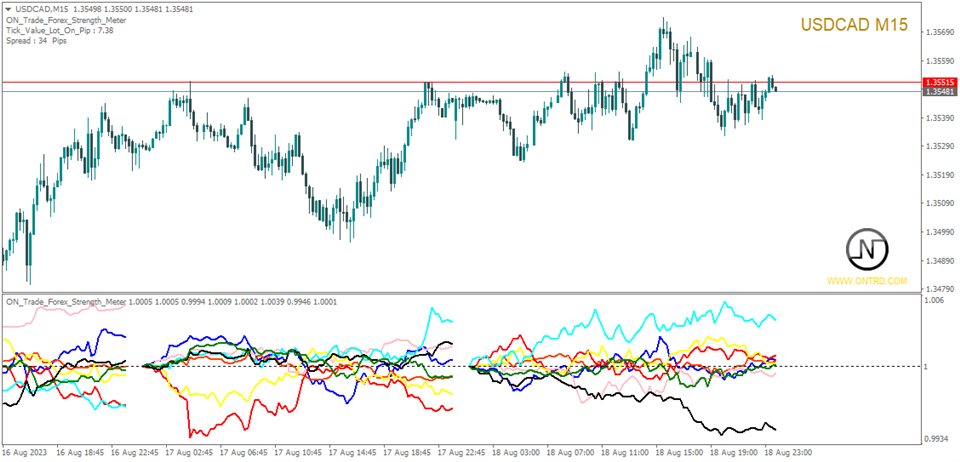

The ON Trade Currency Strength Indicator (CSI) is an advanced tool that helps forex traders gauge the relative strength and weakness of different currencies within the market. By analyzing the performance of a currency against a selected basket of other currencies over a specific timeframe, this indicator enables traders to make informed decisions based on emerging trends, divergences, and potential trade opportunities.

How It Works

Forex trading involves trading currency pairs, where one currency is bought while another is sold. Understanding which currency is strong and which is weak at any given moment can help traders make better decisions regarding entry and exit points.

The Currency Strength Indicator performs calculations to determine the overall strength of each currency in relation to others. These calculations are based on multiple factors, including:

- Price movements across various currency pairs

- Weighted averaging of relative strength

- Trend analysis within a given timeframe

By visualizing this data on a chart, traders can quickly assess which currencies are currently dominant and which are underperforming.

Key Features & Benefits

1. Currency Strength Calculation

The indicator analyzes and calculates the strength of individual currencies over a chosen period. This involves:

- Measuring how a currency performs against multiple other currencies within a set timeframe.

- Identifying relative strength and weakness.

- Providing a numerical or visual representation of each currency’s strength.

💡 Why It Matters: Traders can determine whether a currency is appreciating or depreciating, helping them choose profitable trades.

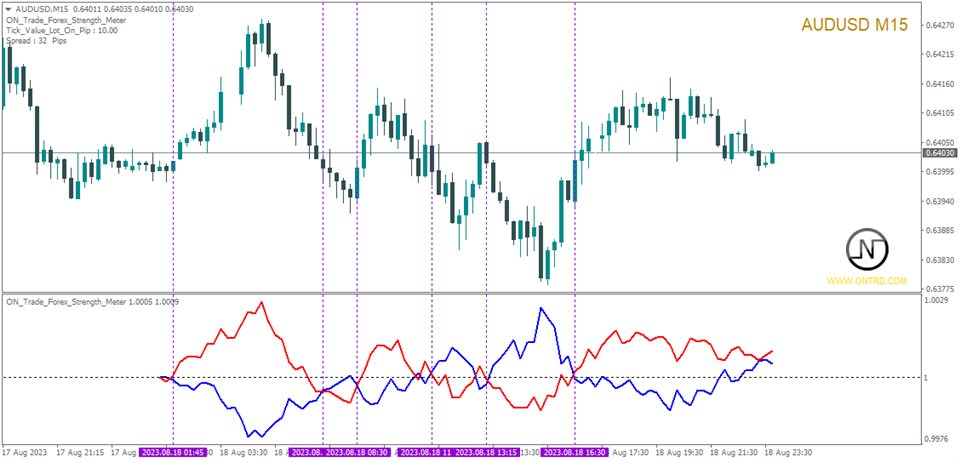

2. Identifying Divergence and Convergence

One of the most powerful aspects of this indicator is its ability to detect divergence and convergence between currency strengths.

- Divergence: Occurs when one currency is strengthening while another is weakening. This suggests a strong potential trade setup.

- Convergence: When multiple currencies show similar strength, it may indicate consolidation or a less favorable trade setup.

💡 Why It Matters: Spotting divergence early can help traders take advantage of major market moves before they happen.

3. Crossing the Zero Level

The indicator also tracks moments when a currency’s strength crosses above or below the zero level.

- Above Zero: Indicates that a currency is gaining strength, suggesting a bullish outlook.

- Below Zero: Indicates a weakening trend, suggesting a bearish outlook.

These zero-level crossovers act as signals to enter or exit trades, adding an extra layer of confirmation.

💡 Why It Matters: Traders can use zero-level crossings to confirm trend reversals or continuations before placing trades.

4. Customizable View for Traders

Every trader has their own strategy, and this indicator offers customization to match different trading styles.

- Traders can choose to display strength data only for specific currencies (e.g., USD, EUR, GBP, JPY, etc.).

- Ability to filter out unnecessary data and focus only on relevant currencies.

💡 Why It Matters: Filtering out unneeded information makes decision-making more efficient and tailored to individual trading preferences.

5. Strength Time Frame Selection

The Strength Type parameter allows traders to select different time frames for currency strength calculations.

- Short-term traders (scalpers) may prefer shorter time frames (e.g., 5-minute, 15-minute charts).

- Swing traders may analyze strength on a daily or weekly basis.

- Long-term investors might use monthly time frames.

💡 Why It Matters: Adjusting the time frame helps traders align the indicator with their unique trading strategies.

6. Current Pair Strength Display

The indicator includes a “Show Current Only” parameter, which allows traders to focus solely on the forex pair they are analyzing.

- Instead of viewing all currency strengths, traders can zoom in on the pair they are actively trading.

- Helps avoid distractions from unnecessary data.

💡 Why It Matters: This feature ensures a focused analysis of the currency pair in question, making decision-making more precise.

7. Historical Analysis & Trend Identification

The “Bars Limit” parameter allows traders to assess historical currency strength trends.

- By looking at past data, traders can identify patterns, seasonal movements, and long-term trends.

- Helps refine trading strategies by backtesting how the indicator performed in previous market conditions.

💡 Why It Matters: Understanding past trends provides insights into potential future price movements.

How to Use the Indicator in Trading Strategies

1. Trend Confirmation

- If a currency’s strength is consistently increasing, it supports a bullish trend.

- If a currency is weakening, it confirms a bearish trend.

🛠 Example: If the EUR/USD pair shows strong EUR strength and weak USD strength, traders might look for buy opportunities.

2. Identifying Trend Reversals

- If a previously strong currency suddenly starts weakening, it could signal an upcoming reversal.

- Divergences between currency strength and price action often indicate turning points in the market.

🛠 Example: If GBP was strong for a long time but starts declining while USD strengthens, it may be time to short GBP/USD.

3. Trading Crossovers

- When a currency strength crosses above the zero level, it may indicate an uptrend.

- When it crosses below zero, it may signal a downtrend.

🛠 Example: A trader might enter a long position when AUD strength crosses above zero and exit when it starts declining.

4. Risk Management Considerations

As with any trading tool, using the Currency Strength Indicator effectively requires proper risk management:

✅ Always use stop-loss orders to protect against sudden market reversals.

✅ Combine the indicator with other technical analysis tools (e.g., support/resistance levels, moving averages).

✅ Be aware of fundamental factors that can impact currency strength (e.g., economic news, central bank policies).

Final Thoughts

The Currency Strength Indicator is a valuable addition to any trader’s toolkit. By providing real-time insights into currency performance, it allows traders to make better-informed decisions, identify profitable opportunities, and improve overall trading strategies.

Key Takeaways:

✔️ Helps traders gauge relative currency strength and weakness.

✔️ Identifies potential trade setups through divergence and crossovers.

✔️ Offers customizable settings to match different trading styles.

✔️ Works best when combined with other technical and fundamental analysis tools.

✔️ Requires proper risk management for effective use.

By mastering this indicator, traders can gain a significant edge in the forex market and improve their trading success. 🚀

if you like this product you can contact :

check also :

Shepherd Harmonic Patterns Indicator

1 Review

Wow Great indicator

Additional information

| Payment Details | Life Time, 1 Year, 5 Days Test |

|---|

Best Currency Strength Indicator Wow!