Price range: 140 $ through 200 $

Description

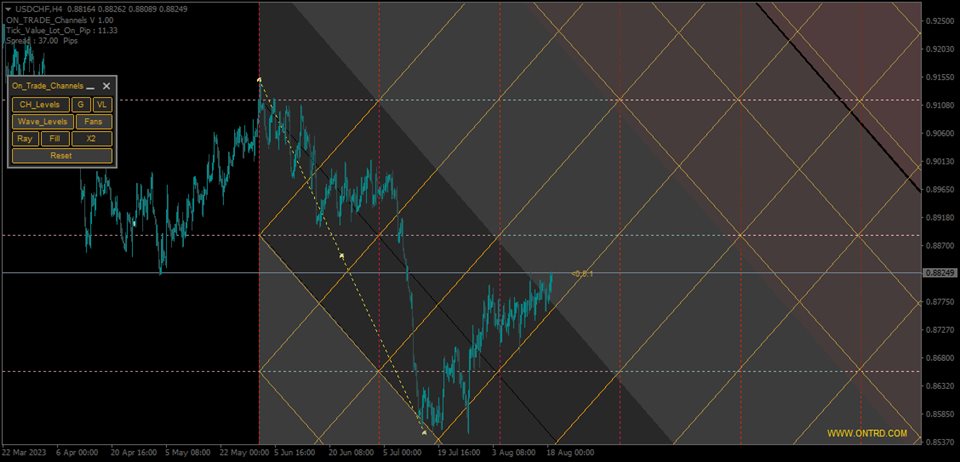

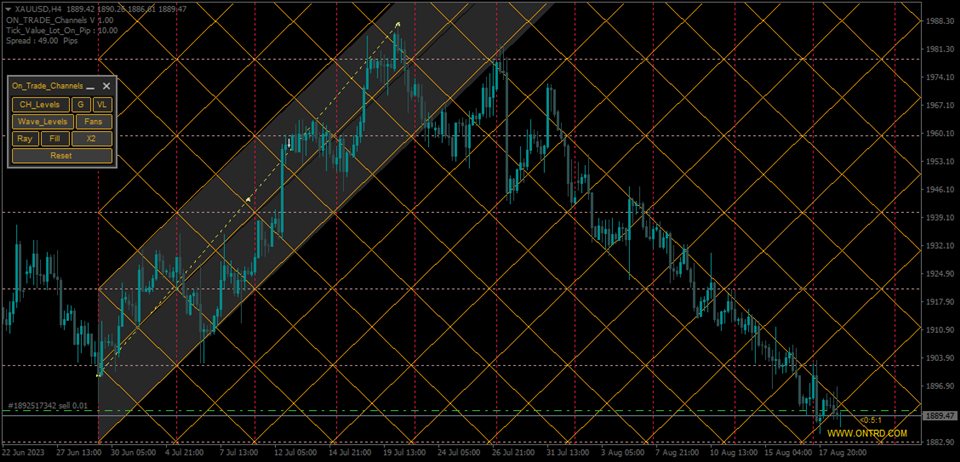

ON Trade Channels: A Comprehensive Guide to Regression Channel Trading

Technical analysis is an essential tool for traders looking to navigate the complexities of financial markets. Among the various tools available, the Regression Channel Tool stands out as a powerful method for identifying trends, support, and resistance levels. The ON Trade Channels indicator takes this concept to the next level, offering traders an advanced way to analyze market trends and make more informed decisions.

This article delves deep into the functionalities, benefits, and practical applications of the ON Trade Channels indicator, ensuring that traders can maximize its potential in their trading strategies.

Understanding the Regression Channel Tool

The Regression Channel Tool is a versatile instrument that provides insights into price movements by analyzing a trend’s linear regression. It helps traders visualize price action in a structured manner, making it easier to predict potential reversals or continuation points.

Key Components of a Regression Channel:

- Main Trend Line: This line represents the average price movement of an asset over a defined period.

- Upper and Lower Channel Boundaries: These lines are positioned above and below the main trend line to indicate possible resistance and support levels.

- Correction Wave Levels: These are secondary levels within the channel that help identify retracements and corrections within the main trend.

Features and Benefits of ON Trade Channels

1. Channel Levels and Dynamic Support/Resistance

One of the core strengths of ON Trade Channels is its ability to automatically generate dynamic channel levels. These levels serve as critical support and resistance zones, helping traders determine optimal entry and exit points.

- In an uptrend: The upper boundary can act as a resistance level where traders may consider selling.

- In a downtrend: The lower boundary can serve as a support level where traders may look for buying opportunities.

- Midline as a target: The center of the channel can act as a reversion level for price corrections.

2. Identifying Correction Waves

Markets rarely move in a straight line. Instead, they experience corrections before continuing in the primary direction. The ON Trade Channels indicator highlights these correction waves, allowing traders to:

- Spot retracement levels within a trend.

- Identify potential breakout or reversal zones.

- Use correction waves for more precise stop-loss and take-profit placements.

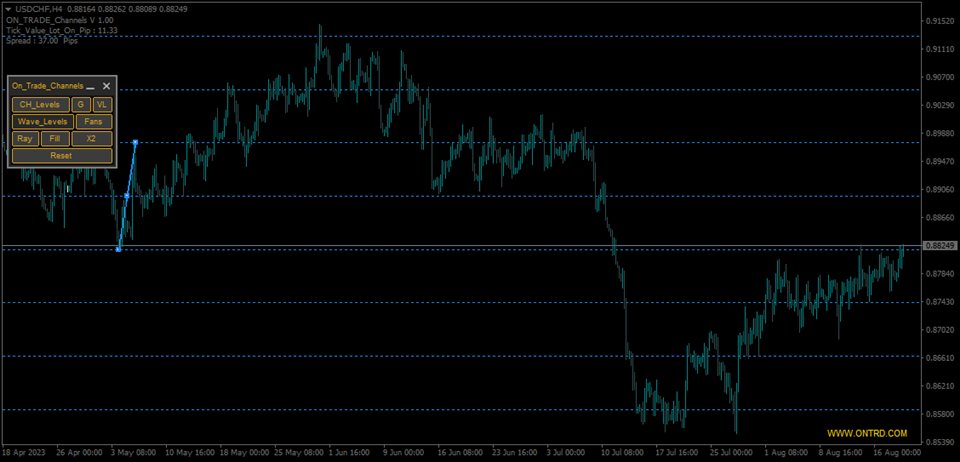

3. Customizable Control Panel

The ON Trade Channels indicator provides a user-friendly control panel, giving traders direct control over the channel’s appearance and functionality. Some key adjustments include:

- Toggling fill and ray options for better visualization.

- Changing channel colors to suit personal preferences.

- Enabling or disabling secondary levels for a more focused view.

4. Multi-Time Frame Analysis

Traders often look at different time frames to get a broader perspective of the market. The ON Trade Channels indicator supports higher time frame analysis, allowing traders to:

- Identify long-term trend channels while trading on lower time frames.

- Confirm trade setups using multiple time frames.

- Enhance trend analysis by comparing short-term and long-term movements.

How to Use ON Trade Channels Effectively

1. Setting the Trend Line

To get started with ON Trade Channels, traders need to place the trend line correctly:

- In an uptrend, the trend line should start from the lowest point of the wave.

- In a downtrend, it should begin at the highest point of the wave.

2. Extending the Trend Line

Once the trend is identified:

- In a bullish trend, extend the trend line to the last low to map out the channel.

- In a bearish trend, extend it to the last high to create the descending channel.

3. Using the Channel Levels Method

- Buy trades: Look for opportunities near the lower boundary of the channel.

- Sell trades: Seek resistance at the upper boundary.

- Stop-loss placement: Set stop-loss orders outside the channel boundaries to avoid premature exits.

4. Targeting Profitable Trades

- The center of the channel often acts as a reliable take-profit level.

- Advanced traders can use additional correction wave levels for fine-tuning their trade exits.

Customization and Parameters

The ON Trade Channels indicator comes with several customizable parameters to enhance its usability:

- Use_System_Theme – Toggle between system themes for better visibility.

- Trends_Color – Customize the color of the main trend line.

- Channel_Color – Choose a color for the regression channel.

- Show_Center_CH_Levels – Enable or disable secondary support/resistance levels.

- Max_Ch_Levels – Set the maximum number of channel levels.

- Ch_Levels_Color – Define the color of the channel levels.

- Max_Wave_Levels – Configure the maximum correction wave levels.

- Wave_Levels_Color – Select a color for the wave levels.

- Upper_Duplicate_Color – Choose a color for duplicated upper channels.

- Lower_Duplicate_Color – Set a color for duplicated lower channels.

- Show_Last_Candle_Counter – Enable or disable the last candle timer.

- Candle_Counter_Color – Change the color of the candle time counter.

These customization options allow traders to tailor the indicator to their unique trading style and preferences.

Best Practices for Using ON Trade Channels

1. Combining with Other Indicators

For better accuracy, consider combining ON Trade Channels with:

- Moving Averages to confirm trend direction.

- RSI (Relative Strength Index) to spot overbought/oversold conditions.

- Volume Indicators to validate breakout signals.

2. Applying Risk Management

- Never risk more than 2% of your capital on a single trade.

- Use stop-loss and take-profit levels based on channel boundaries.

- Consider adjusting position size based on channel width.

3. Backtesting and Optimization

- Before using ON Trade Channels in live trading, backtest it on historical data.

- Optimize the settings for different market conditions.

Conclusion

The ON Trade Channels indicator is a powerful tool for traders seeking better market analysis through regression channels. By providing dynamic support/resistance levels, correction wave insights, and multi-time frame analysis, this indicator enhances traders’ ability to make well-informed trading decisions.

By utilizing the built-in customization features, traders can tailor the indicator to their needs and integrate it seamlessly into their trading strategies. Whether you’re a beginner or an experienced trader, ON Trade Channels is a valuable addition to your technical analysis toolkit.

If you’re looking for a more structured way to trade price trends, ON Trade Channels is the tool that can help you stay ahead of market movements. Start using it today and experience a more refined approach to regression channel trading!

This tool will work for MT4 and MT5

if you want to have this tool Contact us .

Check Also :

1 Review

Good Channels Indicator

Additional information

| Payment Details | Life Time, 1 Year, 5 Days Test |

|---|

Wow this is the best channels indicator i used !