Price range: 75 $ through 150 $

Description

The ON Trade Waves Patterns indicator is an advanced trading tool designed to detect a wide range of market patterns using both manual and automated methods. It enables traders to identify harmonic patterns, Wolfe waves, and Elliott wave structures with precision. This article explores all the detected patterns in detail, explaining their significance and how they can be used in trading strategies.

Here Is Video On ON Trade Waves Patterns:

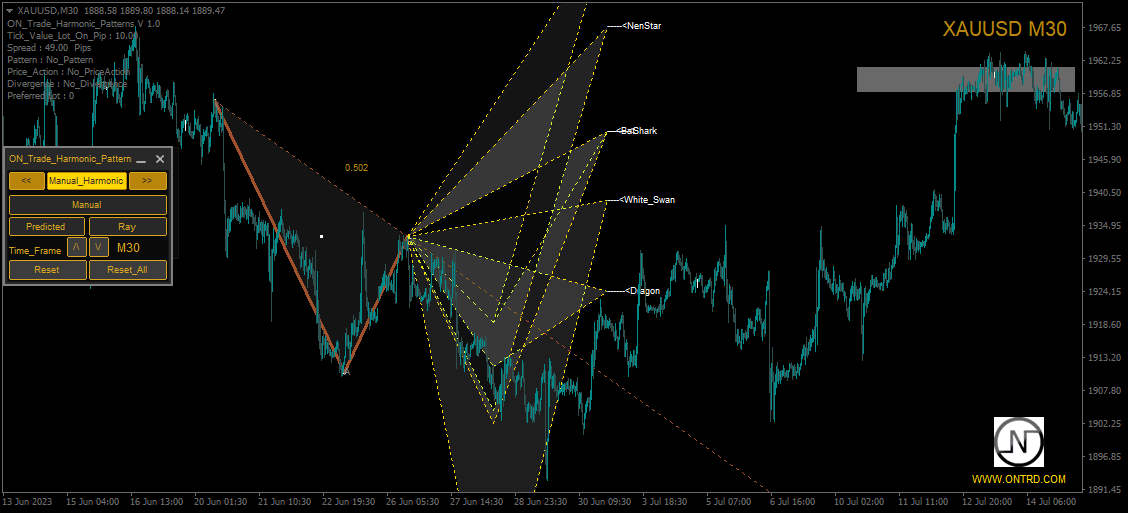

1. Harmonic Patterns

Harmonic trading is a method that identifies recurring price formations based on Fibonacci ratios. The ON Trade Waves Patterns indicator automatically detects various harmonic patterns and provides entry, stop-loss, and take-profit levels.

Supported Harmonic Patterns:

🔹 Gartley Pattern

- One of the most well-known harmonic patterns, identified by a structure resembling the letter “M” or “W.”

- Indicates potential reversals and provides strong entry points when the pattern is completed near the 78.6% Fibonacci retracement level.

🔹 Bat Pattern

- Similar to the Gartley but with deeper retracements, typically ending at the 88.6% Fibonacci level.

- Considered a strong reversal signal when confirmed with other indicators.

🔹 Crab Pattern

- Features an extreme extension, often reaching the 161.8% Fibonacci level.

- Provides high-risk, high-reward opportunities.

🔹 Deep Crab Pattern

- A variation of the Crab pattern with a deeper retracement before the final leg extends aggressively.

🔹 Butterfly Pattern

- A pattern that extends beyond the original swing high or low, reaching the 127.2% or 161.8% Fibonacci levels.

- Often used for aggressive counter-trend trading.

🔹 Shark Pattern

- A five-leg pattern that emphasizes deep Fibonacci retracements and projections.

- Used to anticipate strong reversals in the market.

🔹 Cypher Pattern

- A rare pattern that does not adhere strictly to the traditional harmonic formations but follows a unique Fibonacci structure.

- Typically used for trend continuation setups.

🔹 White Swan & Black Swan Patterns

- Unique variations of harmonic structures that focus on deep retracements and rapid price expansions.

- Often used in volatile market conditions.

🔹 Dragon Pattern

- A simplified harmonic structure that identifies potential trend reversals based on price action rather than strict Fibonacci ratios.

🔹 Anti-Gartley, Anti-Bat, Anti-Butterfly, and Anti-Crab Patterns

- These patterns represent inverse versions of their respective harmonic formations, signaling potential trend continuations instead of reversals.

🔹 ABCD Pattern

- A fundamental harmonic structure based on Fibonacci relationships.

- Often used as a confirmation tool for larger harmonic formations.

There is also manual drawing part tp predict pattern depend on waves :

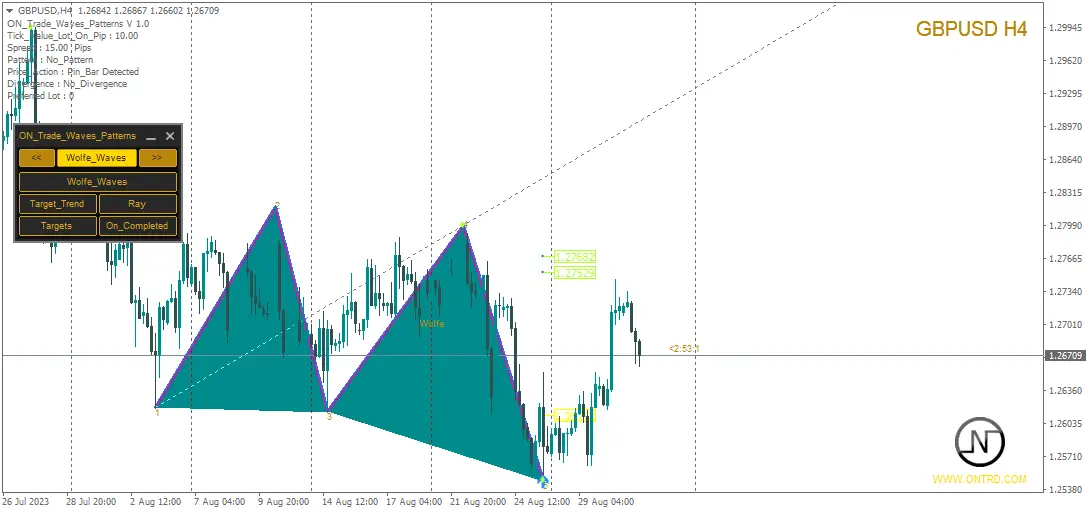

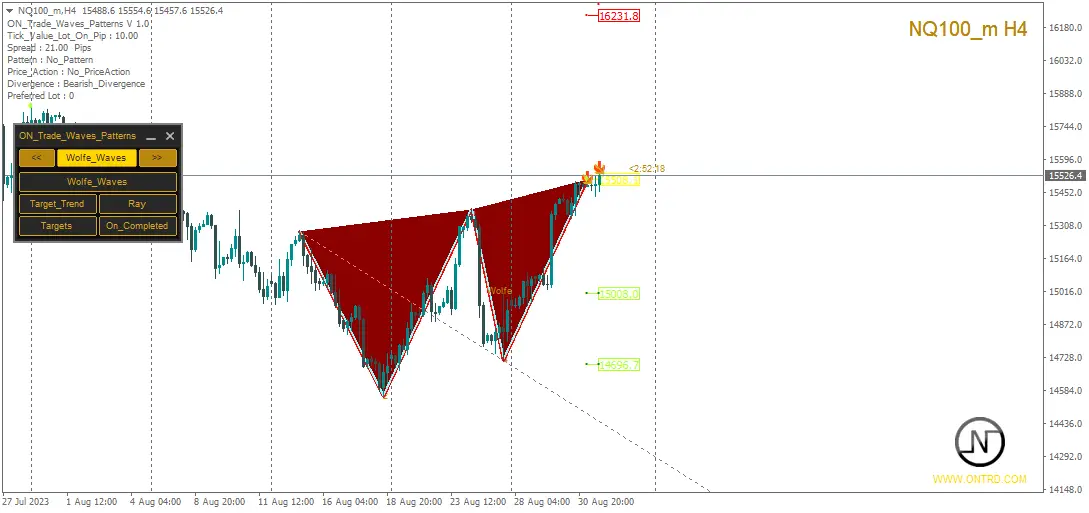

2. Wolfe Waves

🔹 What Are Wolfe Waves?

Wolfe Waves are a five-wave pattern that appears naturally in financial markets, signaling potential price reversals. The ON Trade Waves Patterns indicator detects these formations automatically and marks the key entry, stop, and target levels.

How to Trade Wolfe Waves?

- Entry is typically placed at Wave 5, which is expected to reverse toward the target line (formed by connecting Waves 1 and 4).

- The stop-loss is usually set below or above Wave 5, depending on the trade direction.

- Target levels are determined using the trendline formed between Wave 1 and Wave 4.

Why Are Wolfe Waves Important?

- They help traders identify strong reversal points.

- Provide well-defined entry and exit strategies.

- Can be used in multiple timeframes for high-probability setups.

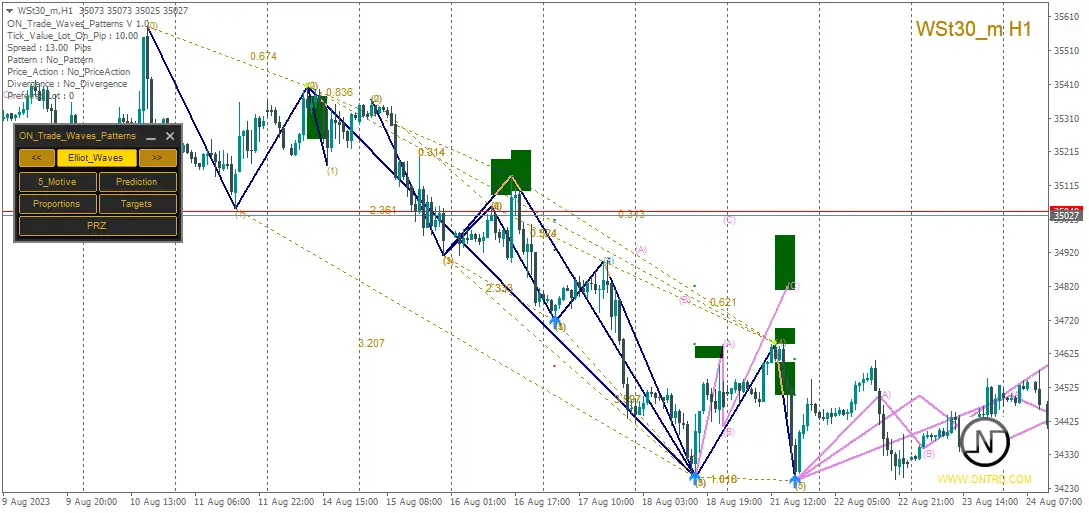

3. Elliott Wave Theory (Five Impulse Waves)

🔹 What Are Elliott Waves?

Elliott Wave Theory suggests that market movements follow a five-wave impulse pattern, followed by a three-wave corrective phase. The ON Trade Waves Patterns indicator automatically identifies the five impulse waves to help traders analyze trends effectively.

The Five Impulse Waves:

- Wave 1: The initial price movement in the direction of the new trend.

- Wave 2: A correction that retraces part of Wave 1’s movement.

- Wave 3: The strongest and longest wave, signaling a powerful trend.

- Wave 4: A pullback that is typically shallower than Wave 2.

- Wave 5: The final upward or downward push before the market enters a corrective phase.

Why Elliott Waves Matter?

- Helps traders understand market structure and trends.

- Provides entry and exit points based on wave formations.

- Can be combined with Fibonacci retracements for greater accuracy.

4. Additional Features of ON Trade Waves Patterns

✅ User-Friendly Control Panel

- Allows traders to toggle different pattern detections on and off.

- Saves chart and timeframe settings for seamless trading.

✅ Automatic Alerts & Notifications

- Alerts for potential pattern completions, ensuring that traders never miss key trading opportunities.

✅ Integration with Expert Advisors (EAs)

- Can be used in algorithmic trading by incorporating the indicator’s buffers in an EA strategy.

✅ Multi-Timeframe Analysis

- Patterns can be detected across multiple timeframes, allowing traders to identify long-term and short-term opportunities.

✅ Custom Lot Size Calculation

- Automatically calculates lot sizes based on risk parameters, helping traders manage their capital efficiently.

How to Use ON Trade Waves Patterns in Your Trading Strategy?

- Use Multi-Pattern Confirmation: Combine harmonic patterns, Wolfe waves, and Elliott wave structures for high-confidence setups.

- Apply Proper Risk Management: Use the lot size calculator and set stop-loss levels accordingly.

- Monitor Alerts and Entry Zones: Take advantage of real-time notifications for entry confirmations.

- Combine with Other Indicators: Use Fibonacci retracements, trendlines, and momentum indicators for added confirmation.

Conclusion

The ON Trade Waves Patterns indicator is a comprehensive trading tool that combines the power of harmonic patterns, Wolfe waves, and Elliott wave analysis. Whether you are a discretionary trader or prefer automated strategies, this indicator provides everything needed to analyze price action effectively and trade with confidence.

📈 Upgrade your trading experience today with ON Trade Waves Patterns and take your technical analysis to the next level! 🚀

This Indicator For MT4 you can have it from Link .

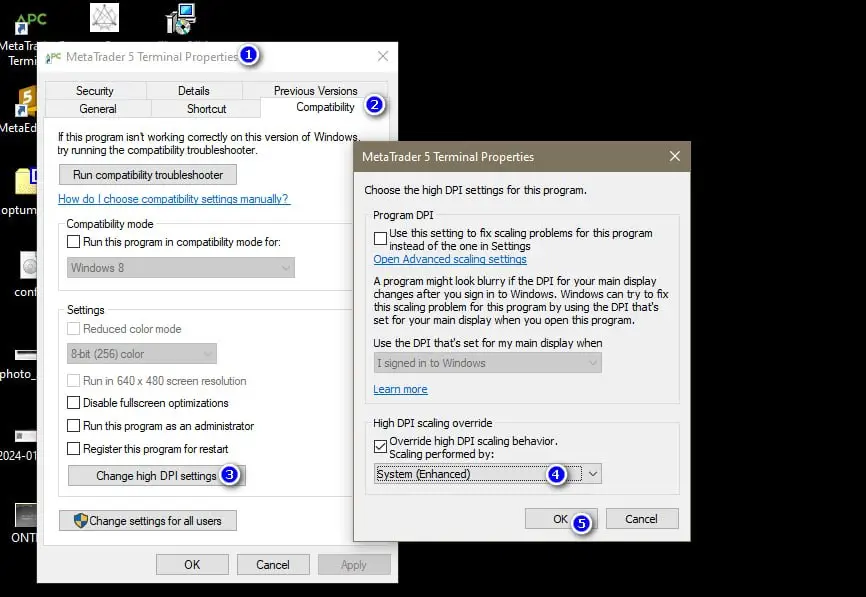

Some Devices Need Fix Scale Make this Solution :

For More Info Contact Us.

1 Review

Best Products

Additional information

| Payment Details | Life Time, 1 Year, 6 Months, 1 Month, 5 Days Test |

|---|

You may also like…

-

ON Trade Optuma Astro – The Great Astronomy Indicator 1st

Price range: 100 $ through 350 $ Select options This product has multiple variants. The options may be chosen on the product page -

ON Trade VSA – The 1st Ultimate VSA Tool

Price range: 10 $ through 150 $ Select options This product has multiple variants. The options may be chosen on the product page

The Best Indicator Ever